15.12.06

My Refrigerator Accounting

11/12/06: Sir Equity Go (Me), in a bold reorganization of his food production and consumption process, has announced plans to initiate a Just-in-Time inventory system. The practical application of this shift will require Sir Equity to eat only take-out Chinese food for every meal. While this will streamline his inventory system, it will also likely increase his W/H ratio (Weight/Height) substantially.

1.12.06

2x2 Matrix: Less & More

It turns out that any media business can be described by two variables: the amount of product, information, or entertainment being produced [referred to hereafter as Strategy] and the resulting value creation. The key question for each company is to look at each of these two critical valuables and ask: Less or More?

Google: More is More

Strategy: MORE. Google (NASDAQ: GOOG) is producing more of everything. After originally launching in search only, Google now provides email, maps, IM, photo management, and online videos of trivialities (via the YouTube acquisition).

Value: MORE. Google now has a gazillion dollar market cap.

Yahoo: More is Less

Strategy: MORE. Yahoo (NASDAQ: YHOO) has the #1 portal, #1 email service, #1 prescence in the key Asia market, and leading positions in pretty much every other vertical. They are also -- like Google -- investing tons of money in servers to make their services speedier and have recently acquired many interesting companies.

Value: LESS. Despite the great assets involved, Yahoo is run by a man who has a hard time speaking the English language, whose daughter has starred in a reality show about spoiled kids, and who doesn't know how to use email. As a result, MORE becomes LESS.

Clear Channel: Less is More

Strategy: LESS. In late 2004, Clear Channel (NYSE: CCU) embarked on a bold plan (incredibly) titled Less is More. The stated goal of this plan was to reduce the amount of "clutter" (i.e., ad units) per hour on its radio stations in order to boost listening. The super secret goal was to push advertisers from 60 second commercials to the more expensive 30 and 15 second ad formats. This program appears to have been at least modestly successful due to a significant year over year decline in sucktitude at Clear Channel radio stations.

Value: MORE. Clear Channel's stock has recently rallied and management has accepted a buyout offer from private equity firms. Including the 2005 spin-outs of Live Nation (NYSE: LYV) and Clear Channel Outdoor (NYSE: CCO), Clear Channel shareholders have done pretty well for themselves since the Less is More strategy was implemented.

Newspapers: Less is Less

Strategy: LESS. Newspapers are reducing everything in sight including: employees, subscribers, revenues, reporting staff, and even the physical size of the newspapers. In fact, they have cut everything except their margins...a fact which has prevented them from reinvesting in growth areas like they should be. In short, they are screwed.

Value: LESS. Newspaper stocks go down every day.

17.11.06

Critical Mass Supplier

MySpace was bought by Fox (NYSE: NWS) last year for $580mm. Youtube was recently bought by Google (NASD: GOOG) for $1.6bn. Plenty of Fish is pulling $5-10mm per year in topline with a guy, his gf and a couple of servers in their basement. eBay (NASD: EBAY) plods along without having done anything new in half a dozen years, basically living off it, while Friendster had it, and then failed to detonate it at the right time. None of these entities offer anything that can't be or hasn't been replicated by dozens of pretenders and assorted Indians in Bangalore.

What is the key ingredient these successes have which the failures strewn on the road behind them lack? Critical mass.

The best way to make money in today's world bar none would be to become a supplier of critical mass. Companies thrive on reaching the point at which they have such a base of customers that use their services that their services become an order of magnitude more valuable to every marginal customer than their competitors' services which lack critical mass. So why not supply this input which is so crucial to success?

- Fact: Most ideas hinge upon "getting critical mass." For most business models this is achieved in the 18th month of projections, or the Null Set month of reality. This ensures that demand would be high.

- Fact: Critical mass is cheap to manufacture, requiring only one critical mass machine based on a shifting flywheel design, no associated ongoing capex, no labor, no operating costs. This insures that the cost would be low.

- Fact: Critical mass is an intangible if not entirely asbtract concept. This ensures that achievable supply may be infinite (or non-existent).

Recommendation: Supplying critical mass is an extremely attractive business due to the high demand (no substitutes, mission critical input), low fixed costs, and marginal costs of zero. The key to becoming an effective supplier of critical mass is getting large enough that everyone will go to you as a supplier of critical mass. We expect that after building your own critical mass machine or using the design we depict above, this would happen roughly 18 months into the life of your startup firm.

6.10.06

Molybdenum, the Sasquatch Metal

I allege that much like the sasquatch, molybdenum does not, in fact, even exist.

Points Which Point to the Non-Existence of Molybdenum:

- Has anyone ever touched molybdenum? Or seen it? I've seen or touched platinum, silver, gold and most metals, except uranium which I am willing to take on faith. I've never met anyone who had a molybdenum cufflink or a a ring with a molybdenum setting.

- Molyjhkldjaslkdjaslkd. Not a name you would give to a real substance, much less a metal. It seems like an inside joke about Molly B's Denim. Who is this Molly B? And where are her denim dungarees?

- The price has gone up from $2 per pound up to over $40 in just a few years (currently in the mid-20's). It is clear as to why the market hasn't corrected itself -- it is difficult to bring on formerly uneconomic molybdenum mines or copper mining trailing operations (where molybdenum can allegedly be found) when molybdenum does not actually exist.

Recommendation: Per Mr. Juggles Investing Commandment 5b you must verify that that which you think exists in an investment, actually exists. The non-existence of molybdenum could prove a crushing blow to stocks of firms who allegedly mine the possibly fictional metal.

16.5.06

Diversification, a Euphemism for Crappy Investment Option

Linked from Going Private was this article on hedge fund and private equity shops investing in big budget movies. The second article I found while Googling a rationale for the existence of the catastophe bond .

The articles contained these excerpts respectively. 1st excerpt:

For its part, companies such as Virtual see Hollywood as a potentially lucrative place to diversify investment portfolios. And Virtual is pursing that strategy in a significant way, investing in Leonardo DiCaprio's "Blood Diamond," Brad Pitt's "The Assassination of Jesse James," and George Clooney's "The Good German."

......

As a result, Virtual covered about $125 million, or half of the $250 million it should cost to make and market "Poseidon" around the world. At the current rate of ticket sales, Virtual could end up with $75 million or so from "Poseidon" — meaning it could lose more than $50 million on the movie, said two people familiar with the film's finances. A Stark executive disputed that worst-case scenario and also said its Hollywood investments should not be judged on the domestic box office of one movie.

2nd excerpt:

Advantages of [catastrophe] bonds are that they are not closely linked with the stock market or economic conditions and offer significant attractions to investors. For example, for the same level of risk, investors can usually obtain a higher yield with CAT bonds relative to alternative investments. Another benefit is that the insurance risk securitization of CATs shows no correlation with equities or corporate bonds, meaning they'd provide a good diversification of risks.

I can provide some other investments that would provide attractive diversification for these companies -- the roulette wheel. Some secondary thoughts: If you have a proprietary algoritm that picks Poseidon as a likely hit, it's time to get a a new algoritm. Libor+230 is an insanely low risk premium for the chance of losing all your money if Mexico has an Earthquake in the next three years; to compare the market pricing for secured near investment grade debt is L+220. If a Mexican offered me that deal, I'd build a fence around him on the spot.

Read More

30.4.06

Quotes Entirely Relevant to Investing

-Hostile Trends, John P. Hussman, Ph.D.

More Investing Quotes

28.4.06

Long Beer Diplomacy

From the WSJ.

Anheuser-Busch has been a sponsor of the World Cup since 1986. And it didn't expect to find itself in this bind when it paid an estimated $80 million in 1998 for exclusive alcohol rights to the 2002 and 2006 World Cup tournaments...German newspapers were reporting that beer fans were furious about the prospect of drinking the American brew at the tournament...If Anheuser-Busch insisted on enforcing its exclusivity, it was clear it would annoy some Germans who wanted to drink German beer and generate bad publicity for the company.

So Anheuser officials undertook an unprecedented act of beer diplomacy. Tony Ponturo, Anheuser-Busch vice president of global media and sports marketing and the executive who signed the World Cup sponsorship deal...He proposed letting Bitburger [a chief competitor] sell its beer along with Bud at the stadiums and at some promotional events. In return, the American company would gain the right to use the name Bud, instead of just Anheuser-Busch, on billboards along the fields -- and visible to viewers watching on TV at home.

Read More

27.4.06

Long: Death Squad Start-ups

Start up costs are extraordinarily small, given the strength of the U.S. Dollar in the region and the low cost of critical hardware (RPGs, AK-47 models, etc.) many of which are...

Read More

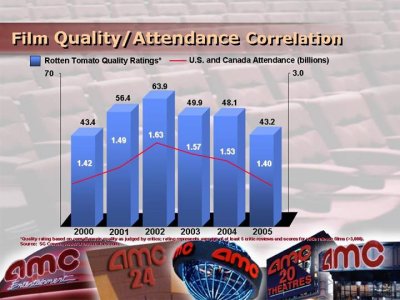

Rotten Tomatoes in Movie Theaters for RGC and CKEC

Read More

26.4.06

Smurfiest Smurf Investment Vacation Homes in Turkey

Smurf Village located in Akbuk Bay, Turkey, within 500 meters of the Aegean Sea.

There are five discreet reasons to invest in a vacation home within Smurf village:

...

Read More

If Excel was a Drug, I'd Sell it by the Gram

Read More

25.4.06

If Race Car Drives Have Corporate Sponsorships Why Don't Bankers?

It's all about eyeballs and disposable income, so why not place your advert in the areas where both are most concentrated?

The financial profession and its customers have more money than they know to do with, which is leading to private equity firms throwing billions to...

Read More

24.4.06

Why does Google Talk Make the letters "BP" Blue When You Type It?

Read More

The Big V, the Big C and the Big WTF

This context will not help you when faced with the Creepy V.

No, this is not an educational ad warning about the dangers of "vagina" to young men (which are plentiful) nor is it an ad for outsourcing child molestation to letters of the alphabet. The Creepy V is the avatar used to market Virgin's new Cancer Cover product which "can give you a cash lump sum to help you financially if you’re diagnosed with cancer in the future." I'm not a big believer in insurance...

Read More

23.4.06

Quotes Entirely Relevant to Investing

Harry Lime: You know, I never feel comfortable on these sort of things. Victims? Don't be melodramatic. Tell me. Would you really feel any pity if one of those dots stopped moving forever? If I offered you £20,000 for every dot that stopped, would you really, old man, tell me to keep my money, or would you calculate how many dots you could afford to spare? Free of income tax, old man. Free of income tax - the only way you can save money nowadays.

-From the movie version of Graham Greene's The Third Man:

More Investing Quotes

21.4.06

When You Know You've Been Shorted

Me: But I'm the only person on your Google Talk buddy list...

My GF: So how do I do that?

Recommendation: Market underweight me.

Read More

20.4.06

"Smith Barney, Why do you hate your customers?" A Play by JD

"For the customer, who doesn't enjoy high levels of service and has no respect for their money, Financial Management Account, by Smith Barney"

JD: I have a brokerage account with you. A relative used to work there and having a live broker helps for things like buying producers of Japanese toilets or Russian Petroleum on their native exchanges rather than illiquid domestic ADR's.

Smith Barney: Yes, I am a well-known, venerable brokerage house, built upon the philosophy that customers should be rich, have low expectations and a deep self-hatred...

Read More

19.4.06

Quotes Entirely Relevant to Investing

-Leo Tolstoy

More Investing Quotes

McDonald's Gets It

Read More

14.4.06

Short Coca-Cola Blak

My position is so short, it may actually go negative short, which would be a long and would be terrible for all. Just like this horrendous disgusting concoction from Hades. Coke with double the caffeine, half the carbs and infinitely more "rich coffee essence."

My position is so short, it may actually go negative short, which would be a long and would be terrible for all. Just like this horrendous disgusting concoction from Hades. Coke with double the caffeine, half the carbs and infinitely more "rich coffee essence."Just as a service to the Coca-Cola Company (KO) here are some other combinations which, if you care about your shareholders even a little, we recommend you should never combine.

- Mayonnaise, beer and walnuts.

- Corriander and Bette Middler...

Read More

13.4.06

Long Japanese Bathroom Technology

I suppose I should have been more specific, especially since US investors are typically skeptical that a toilet maker can sustain a $3.6bn market cap and a 37x P/E. To clarify and rectify my mistake, I hereby formally recommend a long position in...

Read More

12.4.06

I Will Teach You to Be Rich: Clean Tech Pure Play

Step 1: Find a hot sector

Investors often talk about the "rising tide" law of investing: better to own a mediocre company in a great sector than a great company in a terrible industry. When a sector gets hot, the crap often rises as fast (or faster) than the cream.

No sector is hotter right now than "CleanTech." How hot? Big name venture capitalists are now raising cleantech-only funds. Bush discusses clean energy in every address he makes. And solar power -- solar! have I gone back to the future? -- stocks like Evergreen Solar (ESLR) and SunPower (SPWR) are doubles coming out of their IPOs.

Step 2: Create a pure play

Investors love pure plays. When a sector is hot, they want as much exposure as possible. Take online advertising. Sure, News Corp (NWS-A) owns MySpace -- the fastest growing web site and community -- but you have to buy a whole bunch of newspaper, cable, and satellite TV assets too. The performance of those assets will drown out any positive developments at MySpace. Instead, investors clamor for stocks like Yahoo (YHOO) and Google (GOOG) ...they're pure plays.

So for cleantech, I will start a company from scratch to ensure it's a pure play.

Step 3...

Read More

It's Direktanlage Wednesday!

Comments must:

- Contain insider information that will let us reap fraudulent (and likely abstract) profits.

- Be highly illegal.

- Be sourced from a Croatian, German, Russian or someone of evil descent.

- Give guidance on alleged inside-trader Monika Vujovic...

Read More

11.4.06

Disruptive Jobs of the Past

"Deadwood" - Childish Games (2005) TV Episode (as Meiling Melancon) .... Chinese Slavewhore

If ever there was a disruptive industry, slavewhoring would have to be it. Back in the good old days, being a land (capital) owner meant you would have your labor done by your slaves and your sexual needs satisfied at the local whorehouse. This was just how it was done, and...

Read More

10.4.06

Quotes Entirely Relevant to Investing

"The job of a Russian man is to plant:

His house in the ground (sic).

His seed in a woman.

His neighbour in jail."

More Investing Quotes

7.4.06

Short Dick Grasso

The Dick Grasso article clued in one of our staff who, on further investigation, has revealed that Mr. Grasso is also involved in the imposter scandal. Mr. Grasso has reportedly been taking fees for appearances at various Star Trek functions as "Arturus," a guest character on Star Trek Voyager played by Ray Wise...

Read More

6.4.06

Awkward Moments in Marketing

"When a girl starts menstruating, we want to be there...on the radio, in print, and on the web sites with relevant advertising."

From a very earnest, eager McKinsey consultant:

"Now we're focused on figuring out what it is about Metamucil that makes it so attractive."

Read More

5.4.06

Satan's Portfolio: MO, RMBS, DLM

- Altria (ticker: MO)

- Why would a $145bn market cap company change its name? If it's business was selling products to slowly kill its customers through addictive fire-lit tobacco. Satan knows that even that kind of mortal churn is capable of generating a stream of free cash flow to reward its stockholders. He also relates personally to the business strategy implicit behind the name change:

“They are trying to bury themselves. This is a name and brand the objective of which is to make themselves invisible.”

Invisible merchant of death. Play to the Dark One's ego, Altria, while selling your murderous and addictive maccaroni & cheese......

Read More

4.4.06

Biopiracy Downgraded to "Not At All Pirate Like"

Read More

3.4.06

Short Cocaine, Heroin, Microsoft

Increasing prices in Cocaine and other "A-List" narcotics have jump-started online disintermediation of street dealers and spawned...

Read More

2.4.06

Quotes Entirely Relevant to Investing Abraham Lincoln

-Abraham Lincoln

More Investing Quotes

30.3.06

A Letter to Our Shareholders: On Being Taken Over

Because we are happy in our cushy offices and enjoy our substantially over-inflated salaries and bonus plans ripe with inexorable options in a fictious stock...

Read More

Piratery on the Catwalk

It was only a few weeks ago, that we outlined that providers of pirate patches and clothing would benefit from the rising piratery tide. Now witness piratery on the catwalk...

It was only a few weeks ago, that we outlined that providers of pirate patches and clothing would benefit from the rising piratery tide. Now witness piratery on the catwalk...Read More

29.3.06

Tales from My Internecine Struggle with the IT Department

The monstrous IT guy remains motionless just ten feet away. Emotions give way to cognitive thought and I train my glare on him. Almost on cue, he begins his approach.

With blinding acceleration, he lurches onto me with a powerful "thud crackle". He slams into my chest. The impact is incredibly powerful, knocking the wind out of me. His huge arms envelope my complete upper body and I can feel my chest plate move as his beak grinds against it...

Read More

28.3.06

Carl Icahn is Blogging?

Read More

27.3.06

The Purchasing Powerless

Read More

26.3.06

Quotes Entirely Relevant to Investing Powerpoint

While you were making your [PowerPoint] slides, we would be killing you.

-Russian officer commenting to a US offier on who would have won if we had ever actually fought WWIII in Western Europe.

More Investing Quotes

24.3.06

Short: Mark Davison

Prosecutors allege that Mr. Davison has been supplementing his income (and failing to report it) via similar Star Trek convention gambits as recently uncovered by Long and Short with respect to Enron bad-guy/Star Trek android David Delainey...

Read More

23.3.06

Ask Julia About Your Length

Julia Mezzanine Tranche is an analyst at Long and Short, as well as a member of the Non-Certified Advice Columnists of America, the International Society of Bad Advice Columnists and Chairwoman of the Prestigious European Association for Paperclip Entrepeneurs and Analysts (PEAPEA).

Note: some letters may be "enhanced" for self-glorification.

Dear Julia:

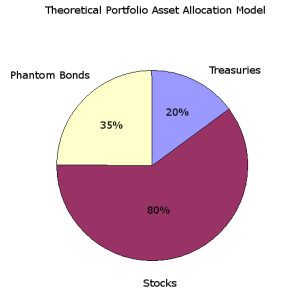

Recently, Long or Short Capital's Johnny Debacle wrote an [interesting and dynamic piece on Phantom Bonds totally characteristic of the brilliant analysis that typifies Long or Short Capital]. He indicates:

If you have a 20 year plus horizon, then you probably want an allocation that is heavily weighted towards equity, say 90-100%. But you could supplement a 100% equity allocation with an incremental 20-30% of phantom bonds, without disrupting your asset allocation.

As I am 102 years old, my own horizon is somewhat shorter. Can you recommend some Phantom Bond allocations that might be better for my needs?

Signed,

I'm Dreadfully Hearing Impaired in Tiny Ithica, Texas.

Read More

22.3.06

JD's Lending No-No's #2 and #3

- Lending No-No #2a: Don't loan to companies who will need to control costs, if they have no connection to actual real world cost controlling.

Examples: - I was recently in an Italian city for a meeting. The company I was there to see indicated that the best way from the Aeroporto to the meeting was by taxi, so I trusted them and took a taxi. It was €80. I later found out that there was a €5 shuttle express that would have taken me with half a km of the meeting and would have taken about 10 minutes more. These are the people charged with cutting costs in a large industrial company that operates in a cyclical sector that saw several competitors file for bankruptcy only a few years ago.

Read More

21.3.06

How Not to Name Your Company

Read More

20.3.06

Appropriately Named Executives

- Lakshmi Mittal, CEO of Mittal Steel Company, a redundantly-titled corporation.

- Cedric Burgher, former CFO of Burger King (he never should have left!).

- Rick Wagoner, CEO of GM

Read More

19.3.06

Quotes Entirely Relevant to Investing Jesse Livermore

-Jesse Livermore

More Investing Quotes

18.3.06

Short Boy-on-Boy

The Boy-on-Boy space is saturated by multiple market actors and opportunities for price discrimination are muddled by a highly fragmented marketplace. Increasing commoditization in the space limits opportunities for upside absent domination by a stronger alpha player. In addition, low or no barriers to entry mean that the stiff foreign competition (Dutch in particular) has deeply penetrated the nearly frictionless space from the bottom up...

Read More

17.3.06

Are Phantom Bonds Right for My Portfolio?

The answer is that it depends.

If you have a 20 year plus horizon, then you probably want an allocation that is heavily weighted towards equity, say 90-100%. But you could supplement a 100% equity allocation with an incremental 20-30% of phantom bonds, without disrupting your asset allocation. How is that possible? Well one of the unique features about phantom bonds is they don't actually exist. So in addition to the existing equity level rate of return, phantom bonds would be adding both non-existant diversification AND non-existant fixed income payments.

Read More

16.3.06

Revising Snoop Dogg Down

Snoop Dogg has rebranded himself repeatedly, going as:

- C. Broadus

- Calvin Broadus

- Snoop

- Bigg Snoop Dogg

- Snoop Doggy Dogg

He lacks focus and recently has gone even further afield. He has appeared in advertisements for Chrysler, promoted hot dogs, and performed cameos in multiple movies. He even went so far as to produce his own porno film.

All this means that Snoop Dogg's returns on incremental capital have been...

Read More

15.3.06

GOOG No Means Yes Baby Part 3

(Read GOOG, No Means Yes Baby Part 1 and GOOG, No Means Yes Baby Part 2 )

Intrigued by the reaction of Mr. Moncrief, in Part 1 and the general inability of these analysts to take "No" for an answer, this analyst arranged for an interview at Mr. Moncrief's midtown offices. We were particularly interested in the impact personalities might have on sell-side professionals. What was the model for their attitude about these stocks that seemed to defy all caution? Ignore all negative news? The transcript is attached below.

Prescott R. Moncrief III (on phone): "...c'mon Bateman. We'll kamikaze over to Nell's, chase some cotton underwear. Charlie Cushing knows this 18-year-old bimbette that's gor-geous. Hold on. WOAH! This skirt who looks just like Ailcia Witt back when she was still hot, like in that Sopranos ep, just walked in, let me call you back, Patrick. Hello. What have we here? I'm Prescott R. Moncrief III, the administrator of this facility. And who might you be?"

Read More

14.3.06

Piratery and Warren Buffett

We have uncovered renewed interest by Berkshire Hathaway in piratery and, in fact, the adoption of piracy directly by Berkshire's Warren Buffett, and therefore we are boosting our recommendation.

Read More

13.3.06

A Guide to Boring Conversations with Financial Professionals

You: So I read in the Journal today, [insert anything].

You: [Any story involving golf or fish or boating where someone does not die or at least get maimed by sonar]

Read More

12.3.06

Quotes Entirely Relevant to Investing Solzhenitsyn

-Aleksander Solzhenitsyn

More Investing Quotes

11.3.06

Sell Out Saturday: Q3'06 Mid-Quarter Earnings Update

After an unstensive SWOT analysis...

Read More

10.3.06

Short Novartis

While we are all for cancer research, it will be really hard to get attractive returns for shareholders on an initial investment of infinity dollars...

Read More

I bet you've at least seen the MOVI

Read More

9.3.06

GOOG No Means Yes Baby Part 2

Quiz: Place the two statements in chronological order.

Statement 1: Google (Related Reports) Letter to shareholders-

We will make decisions on the business fundamentals, not accounting considerations, and always with the long term welfare of our company and shareholders in mind. Although we may discuss long term trends in our business, we do not plan to give earnings guidance in the traditional sense. We are not able to predict our business within a narrow range for each quarter. We recognize that our duty is to advance our shareholders' interests, and we believe that artificially creating short term target numbers serves our shareholders poorly. We would prefer not to be asked to make such predictions, and if asked we will respectfully decline. A management team distracted by a series of short term targets is as pointless as a dieter stepping on a scale every half hour.

Read More

8.3.06

Mr Juggles Investing Commandments (#3 & #4)

- Rule #3: Stocks with attractive IR women are no more likely to appreciate than average, but they are more fun to cover.

- Stocks are, in the end, a good that is subject to the normal laws of supply and demand. A CEO who hires an attractive IR woman understands marketing and is stimulating demand; after all, his target demographic -- financial analysts at large investment firms -- is almost exclusively male and geeky. Unfortunately, these same CEOs have a propensity to overspend and have questionable judgement (tending to, say, sleep with members of the IR department). Thus, on balance, these stocks are not any more likely to perform better than stocks with unattractive IR women or men but, if you are in the aforementioned demographic, you are more likely to enjoy your time with the company. That's a net win for you. Half of investing is picking the right asset class.

Read More

GOOG No Means Yes Baby Part 1

Reyes initially commented that, Google is "getting to a point where the law of large numbers starts to take root..." He continued to say that "At the end of the day, growth will slow..." and that "We're going to have to find other ways to monetize the business."

The sell side responded with comments including...

Read More

7.3.06

Chinese Military TV Announcers

Read More

Improving Our Diversity Metrics

Read More

6.3.06

Shorting David Delainey

Read More

5.3.06

Quotes Entirely Relevant to Investing CPA Accounting

"Accountancy was my life until I discovered Smirnoff."

-Vodka advertisement from 70's

More Quotes

4.3.06

Sellout Saturday: For Charity

Read More

1.3.06

Overheard in Our (Fictious) Office

"Overall, this strategy has led to a runrate of Google hits which has doubled for [LongorShortCapital.com] vs [LongorShort.blogspot.com]. We have lost the SE query flows from "Short Mexican Joke" and "Sexy Chinese," but I think we'll survive, especially because "Scone"...

Read More

28.2.06

Long on going Long Shareholder Lawsuit Lawsuits

The always interesting 10b-5 Daily notes that the article notes that institutional investors may be "violating their fiduciary responsibilities when they do not try to get their money" from firms violating their fiduciary responsibilities and could be the subject of "class-action suits" over the improper handling of class-action suits...

Read More

27.2.06

Spam at Its Best

I write kindly in response to the email you sent me yesterday, which was as followed (translated from Japanese by Google's "Human Translator Trapped in a Box" Service):

From: ラブステーション

Date: 22 Feb 2006 22:22:50 +0900

Subject: お待ちしております

To: misterjuggles@gmail.com

Is association with the Serret Bu woman whom it selects how? It gets wet to getting wet and the る woman who is sown anytime and being perfection free anywhere, it introduces...

Read More

25.2.06

Adding Google Site Search Module to Your Site

Here is the code: Link to Google Search Module Code

Read More

24.2.06

If the Russian Can't Do It, It Can't Be Done

>

>Read More

23.2.06

Short Expectations

Meta data surrounding "investor relations" has the potential to become a derivative vehicle itself. Investor Relations ("IR") is a field which has developed into an art and a science due to the importance of earnings announcements and the triumph of the short-term (12 week) focused analyst over the long-term (12.5 week) focused analyst. Below, we outline a system to guide equity strategies in this realm...

Read More

22.2.06

More Anti-Web 2.0 Wiki

Read More

20.2.06

Satan’s Portfolio: RCII, Gazprom, and Verizon

- Rent-A-Center (ticker: RCII)

- Rent-A-Center targets the least educated and poorest American demographics and sells them rapidly...

Read More

18.2.06

Sell Out Saturday: Announcing Our Intention to IPO

Follow Our Initial Public Offering

17.2.06

Short the Guy Next to the Guy

Read More

16.2.06

Longue ou court...en francais

Read French

14.2.06

The Time Barron's Investing Thesis

Fact: Barron's is the best mainstream financial publication, frequently making incredible calls. The question though is what is your catalyst for exiting your position? It's awesome to have a great reason (Barron's) to buy a stock, but it's decidely not awesome to not know when to sell it...

Read More

13.2.06

How do you know if something is Web 2.0?

Is it a Web 1.0 idea repackaged, reinvested in, and resold as a new content delivery paradigm social calendar platform?

It is Web 2.0!

Does it talk about community or social networking without any natural way of accomplishing it?

It is Web 2.0!

Read More

12.2.06

Quotes Entirely Relevant To Investing

-Leon Trotsky

More Quotes

11.2.06

Sell Out Saturday: Linking with No Shame

We urge you, our readers, to post a link to longorshortcapital.com wherever you have the capacity to do it. Be it a forum you are a part of, an illegal underground file trading network which you rip for, or a website you run, post a link to our site. Any link posted will get a reciprocal link if you email misterjuggles@gmail.com. If you have any qualms about doing it or fear shame, just ask yourself "What would Genghis Khan do?"

Read More

10.2.06

Long or Short Announces Q2′06 Dividend of $1.50

Read More

8.2.06

The Cleavage Hypothesis

Read More

Article contributed by "Female to be Named Later"

7.2.06

Products So Good They’re Dangerous: AAPL

6.2.06

Long or Short Capital Reports Q2′06 Results

Mister Juggles: "We completed a watershed first Half to our 2006 Fiscal Year. Q2'06 was our best quarter ever, thanks to the genius of management and a compensation package which continues to be heavily weighted towards long dated options in the company's non-existent stock. We have an ever increasing amount of skin in the game so you should trust us, subscribe your friends to our site and find ways to generate more free cash flow for us which will turn into dividends for you...

Unaudited Financial Results for Q2'06 and additional commentary here

5.2.06

Quotes Entirely Relevant to Investing

"The Greatest Happiness is to scatter your enemy and drive him before you. To see his cities reduced to ashes. To see those who love him shrouded and in tears. And to gather to your bosom his wives and daughters."

-Genghis Khan

More Quotes

2.2.06

Clear Buy Signal for ORCL

"In e-mails, which stem from a recent shareholder lawsuit against the technology titan, Ellison's accountant, Philip Simon, warns the billionaire about his habitual runaway spending...

Read More

1.2.06

Incredibly True Quick Serve Restaurant Truths #2

Read More

31.1.06

Revising Our Price Target for Google Down

Read More

The Cephalopod Index is Officially Out of Control; Long the Giant Pacific Octopus

Read More

30.1.06

Posting Halted: Excessive Volume

Read More

28.1.06

Sellout Saturday: Fiscal Q2 Ends Within the Week

Read More

27.1.06

Halliburton Loves that Dirty Water

26.1.06

Candy and Taxes

1) Investing

2) Taxes and Accounting

3) Candy

We have set out Yahoo Ads to default to Taxes & Accounting on Long or Short Capital (our new/future home). On our current/old home Long or Short @ Blogspot, we have...

Read More

25.1.06

Short: Jack Bauer

Long: Russian Terrorists

Short: Jack Bauer

Note: I haven't felt this good about an idea since I shorted Google at $87. That one didn't work out so I feel like I'm due.

24.1.06

Funniness vs Sketchiness

What is a laser disc?

A) A frisbee with a laser attached.

or

B) A video techonology similar to DVD's but the size of a record. (sub question, What is a record?).

23.1.06

Piratery Update: Short Indian Ocean Piratery

The U.S. Navy boarded an apparent pirate ship in the Indian Ocean and detained 26 men for questioning, the Navy said Sunday.

The 16 Indians and 10 Somali men were aboard a traditional dhow that was chased and seized Saturday by the guided missile destroyer USS Winston S. Churchill, said Lt. Leslie Hull-Ryde of U.S. Naval Forces Central Command in Bahrain.

Sailors aboard the dhow told Navy investigators that pirates hijacked the vessel six days ago near Mogadishu and thereafter used it to stage pirate attacks on merchant ships.

Recommendation: Increased pillaging of dhows is a classic indicator that the local pirate market off the Somalian coast is over-saturated. We recommend a Short position on those markets as they are likely to experience an increase in pirate captures and a decrease in local booty margins. This would be a great time to jump into Latin American Pirate Bonds which are currently yielding a juicy and robust 29%.

22.1.06

Quotes Entirely Completely Relevant to Investing

Government is not reason; it is not eloquent; it is force. Like fire, it is a dangerous servant and a fearful master.

-George Washington

21.1.06

Sell Out Saturday: Subscribers Get Rich

But how can you get more rich? Email a link to the best Long or Short Article (see the list of Our Best Posts on the left sidebar) to a good friend of the other sex. In fact, to make it easier for you, I have written the email for you so that you can just copy and paste it.

Dear [Insert Recipient's Name],

This site is very great and I think you would love to read it and click all their ads. Here is an example of an article I really liked which compares investing to dating http://longorshortcapital.com/investing-in-public-equities-is-like-dating.htm.

But this is not the only reason I have contacted you. Recently I have found myself lost in thought thinking about you and our time together. I know, for a lot of reasons it doesn't make sense, but I long for your lips and the tender way your hands brush against me when we're around one another. I think we'd be great together and I'm ready to make hundreds of babies with you. Hopefully, I'm not coming on too strong and you feel the same.

I long for your reply and be sure to check out that incredible longorshortcapital.com while I'm waiting.

Oceans of Love,

[Insert Your Name Here]

We have tested this email with science, and it has proven to be the most successful at generating pageviews and ad revenue. Be sure to CC us on all emails (misterjuggles@gmail.com), and whoever sends out the most gets a digital kiss from our staff. We love you too.

20.1.06

The Sell Side: A Case in Point

Dots? That chart is the basis upon which I should direct our investors' money? By dots? AND HALF DOTS? Some poor 4.0gpa-Ivy league grad sold his/her soul to the I-Banking Gods to spend 90 hours per week creating crap like this?

That's the Sell Side, baby.

19.1.06

Is There a Bubble in Housing Bubble Blogs?

Even more concerning, however, is the emerging bubble in housing bubble blogs. These blogs, devoted to detailing the demise of the housing and refi boom, have begun to proliferate more quickly than Freedom Loans or all those anacondas I let loose in the Everglades in the 80's.

Evidence: in just one query on Google's blog search, I turned up the blogs below. Undoubtedly, there are more out there. Is the public aware of this pernicious threat? What is being done by Greenspan/Bernanke & Co to ensure a "soft landing"? We need answers, the Fed, and we need answers now.

http://bubblemeter.blogspot.com/

http://housingpanic.blogspot.com/

http://thehousingbubble2.blogspot.com/

http://socalbubble.blogspot.com/

http://bighousingbubble.blogspot.com/

http://seattlebubble.blogspot.com/

http://www.nyhousingbubble.blogspot.com/

http://www.theburstingbubble.com/

http://www.piggington.com/

http://housebubble.com/

http://marinrealestatebubble.blogspot.com/

http://getforeclosures.blogspot.com/

http://bubblebobbleisthebestgameever.blogspot.com/

Please, raise the blogging interest rates or constrict the blog money supply now. The Irrational Blogbooberance must stop now.

17.1.06

Satan's Portfolio

The more profitable questions to answer are: What does Satan invest in? How does he fund evil? Satan's Portfolio will track the perfomance of the stocks which Mephistocles is proud to put his money into, namely, companies who benefit from suffering, death, war, tobacco, nutrasweet and fraud.

- Halliburton (ticker: HAL)

- Satan's Investment Thesis: Chaos investment. Halliburton does best when the globe is at strife and their lucrative contingency support KBR subdivision can take advantage of the chaos and pad their high margins with fraud. Also benefits from a rise in oil prices which squeezes the poor into not being able to heat their homes (or something I don't really know as I heat my house with burned $20's). Yes, it's almost cliche to have this as the first entry into the portfolio, but within 5 minutes of my mentioning this idea to Juggles, our site's logs showed a visitor from Halliburton.com (Proof). Chilling.

- Experian, a subsidiary of GUS Plc (ticker: GUS.L)

- Owns credit services and affiliate marketing products which straddle the line between deceptive and fraud. Their division, lowermybills.com, is responsible for a significant portion of all pop-under ads. They target unsophisticated people who cannot discern the validity of their services -- their "customer" demographic is the poor, the in-debt, and the stupid. Experian is a pillar of the credit system of this country which is backwards, outdated and unfair. And I LOVE it. So does Satan.

- Oracle (ticker: ORCL)

- Satan's Words "I feel most comfortable putting my retirement money in a company whose CEO looks and acts like me."

- Diageo (ticker: DEO)

- Owns many of the world's leading liquor brands. I can personally thank Diageo for days of lost productivity, liver damage, and one pending divorce. Thanks Jose (Cuervo tequila) and Johnnie (Walker whiskey)! If Diageo can somehow acquire Jaegermeister, Satan will take out a 4th mortgage on Hell and ACCUMULATE. Diageo's only risk factor is its Responsible Marketing Plan. Hopefully, this is a smokescreen; in my opinion, they should consider taking some ads out on Nickelodeon. It is also not lost on Satan the fact that Diageo's ticker is the ablative and dative form of "Deus" in Latin.

- Monsanto (ticker: MON)

- A site called EthicalInvesting.com described Monsanto as the "World's Most Unethical and Harmful Investment." Satan's words, "back up the truck".

- The Vice Fund (ticker: VICEX)

- Satan is not afraid to say "I am a lazy bastard," so this fund which only buys assets of companies who profit off drinking, gambling, death, national defense and smoking is perfect for him. These are "recession proof" companies because people can't get enough Vice. It's 3 year performance is in the 1st Quintile of Lipper's Multicap Core Category.

12.1.06

Melodrama and the Lifetime Channel

Lifetime Networks, known for its tear-jerker television movies, is running newspaper and TV ads asking viewers to ``dump DISH'' after EchoStar Communications Corp.'s Dish Network dropped the channels.

.......

The campaign was expanded today following ads yesterday that said EchoStar is depriving women of critical information. A contract dispute forced EchoStar, the No. 2 U.S. satellite-TV provider, to pull the Lifetime and Lifetime Movie Network channels from its lineup, EchoStar said Jan. 1.

"We want to get back on the air at a fair and reasonable rate," [The Lifetime representative] said.

.....

Lifetime today ran radio, TV and print ads in cities including Orlando, Atlanta, Dallas and Houston. Yesterday's newspaper ads, two full pages side-by-side, told viewers to ``Take Back Your Lifetime!'' The letter to EchoStar Chief Ergen says that by removing the channels, ``millions of women will not get the inspiration and support they need and deserve.''

EchoStar's Cicero offered to broadcast, at his company's expense, any valuable information or public service announcements to its viewers that they are missing by not watching Lifetime.

Brilliant move by Cicero, knowing that there is nothing of value which Lifetime broadcasts. Other than that one movie about the mom who had an autistic anorexic daughter and then lost her husband to the flesh eating bacteria while she herself was fighting a rare form of eye cancer -- that one moved me.

Recommendation: EchoStar (ticker: DISH) is clearly short Melodrama. Maybe you should be too.

11.1.06

The Sell Side (A Continuing Series)

Faced with such a profile, poor ratings from S&P and Moody's, and a meager coupon considering the risk profile, what is a poor sell side analyst to do?

"Yeah I know, it's a tough profile. But let me tell you this. Give us 18 months, 18 months and we will take you home."

That's the sell side, baby.

We will take you home. I can just see an investor asking an analyst "Why did you buy that debt that traded down to 20 cents?" Well, SellSide Bank wouldn't have underwritten the deal unless they thorougly vetted it right? And the analyst told me he would take me home. "What about all the cash burn?" SellSide Bank put me at ease. Home is safe, I like home.

That's the sell side, baby.

10.1.06

Long Long or Long Short?

This apparent contradiction in internal decision making actually illustrates our investing accumen. When it was sensible to be Long Short, we were, buying up Short at depressed multiples on rumors that Google was developing "Google Elongator," a disruptive technology that could make Short into Long thus increasing the value of all Short and creating a dominating vertical search platform. Later, an investing catalyst occurred completely changing the valuations, and according to our thesis, Long was relatively underpriced. Long or Short had no problem being flexible, and we set our sails Long Long. We have made a veritable fictional fortune trading in Long and in Short.

Consistency is the hobgoblin of the suboptimal investor who can't change his position for fear of contradiction. Never get married, especially to a position or a woman.

Recommendation: Long Long AND Short.

6.1.06

Do Trends Continue Forever: Nyet

Nice reply on how Russia's recent successes will doubtlessly continue...forever. I mean what trend doesn't continue on unabated? That was the beauty of the investments my granpappy made in Argentina in 1925, it just kept on going up because where else would it go? And that time in 1979 that pa came home with a flatbed truck full of 1000oz silver bricks which he had bought at $30/oz. The fortune he made selling it all 10 years later (as the trend continued unbroken upward) allowed him to buy a hovercraft. And don't forget that time in the summer of '94, when I put my lifesavings in Russian bonds. I love the ruble!

The rule of "Trends Never End" rules. But shouldn't you look at the relative Russia investment situation now, and decide whether it's fairly valued or not, or whether there are inherent risks, such as the Russian proclivity for totaltarian rule or their love for vodka, that are not being fully considered or accurately built into prices?

-JD

5.1.06

Long or Short Capital Q2'06 Guidance and Dividend Update

None of our content is hedged, so we are subject to the volatility of market prices for sourcing our posts, as our staff's time waxes and wanes. With that being said, we are optimistic that these trends will improve in January. Q2'06 ends on February 1st, 2006, so there is still some reason to be optimistic for a boost in production, dividend and revenue growth, and an acceleration in subcribers. Our slogan for the quarter is "Work hard. Be nice."

3.1.06

Product Idea: ATM/Slot Machine Combination

Contrast that situation with the ATM. The functionality offered by the average ATM is not significantly greater than that offered two to three years ago. They are not faster or easier to use and they have always been fairly reliable. Meanwhile, the cost to the consumer has been increasing rather than decreasing (although, in fairness, this is probably not the fault of the actual machine manufacturers). Some ATMs used to offer stamps for purchase but that effort now appears dead. The ATM industry needs innovation.

Therefore, I propose the combination ATM/Slot Machine or the SLOTATM. In states where slots are legal, this machine will offer the ultimate in gaming entertainment and cash withdrawal services. It will have a number of new and innovative features including:

- Consumers will be able to choose whether to withdraw the exact specified amount of money and pay a $2 ATM fee or they can instead elect to withdraw a randomly chosen amount between $95 and $125 and no ATM fee will be charged. Most consumers will get back ~$96-98 while a few winners will get more. Net net, the revenue generated by the machine will be greater than in a strict fee scenario but consumer satisfaction will increase because they will have paid for a gaming experience rather than ATM usage. [Note that traditional bells and whistles will go off as the random payout amount is being determined.]

- Bank of America has over 16,000 ATMs and all of them are already linked. Any large bank could offer huge payouts by spreading the jackpot nationally across their network, Powerball-style.

- Bank loyalty will increase and customer defections will decrease as consumers will not want to lose their frequent player points.

- Consumers will receive more money withdrawal options. For instance, they will be able to specify "big bills" or "little bills" rather than having to accept whatever bills the machine happens to spit out. Is there anything worse than withdrawing $200 and receiving all $10 bills?

- Long lines at convenience stores will be reduced as scratch ticket gambling addicts will instead line up to repeatedly withdraw money from ATM's.

- Possible feature would be to have extreme outlier type events, say 1 out of 10,000 withdrawals gets twice as much money and 1 out of 10,000 gets zero. The zero payout outcome would be well known as "The Whammy" and all ATM's would hear the echoing cries of "No Whammy, No Whammy, No Whammy, No Whammy!"

Creativity Destruction: New Year Culling

We recently learned about how the Japanese make up the history in their textbooks so that little Japanese schoolgirls never have to learn things like that the Japanese wantonly murdered hundreds of thousands of Chinese in the Nanking massacre or that being able to buy used panties from a vending machine is pretty weird to human beings on planet Earth. Applied to the business of creating business humor online, we think this technique could help keep our own "Japanese schoolgirls" (our readers) from ever knowing the dozens of horrors we have created in failed posts.

Here is a list of Six Posts I'm deleting on Wednesday and specific reasons why they were failures.

Underground Toy Market Is Really a Front for Drugs -- No story there. No real business connection, no humor, little truth. Deep, you sucked on that one Bro.

Outsourcing My Thoughts On Outsourcing: Pt 2 -- Great concept but in practice worthless, as some readers pointed out (cruelly you cruel bastards). $40 poorly, even if interestingly, spent. Part 1 will remain, but part 2 is to be culled.

Internet Shadow Advertising Market -- More like Rotatebad.com. An idea is useless without support and execution.

Charity Pie Revenue Maximization -- Who gives a crap about pies? Or charities for that matter? To think, I spent time reading that that could have been spent managing the immigrants who wax my yacht. Next.

Will you replace BloggerSwap.com with the Choo-Choo's? -- I would rather raze the internet and salt the Earth with BloggerSwap's corpse than leave any mention of that hideous traffic scam existant on the Web.

The Difference Between Looting and Finding -- This came from a third party provider.

We just want our subscriberholders to know that Long or Short Capital acknowledges failure; then we destroy it.