11.9.07

Who wants a drink from the Interest Rate Hose

Robert Sinche, currency strategist at Bank of America: "[The job report] sets the backdrop for the Fed to ease. The markets have really been torn in recent days by some signs that some of the data in August was holding up reasonably well. This data certainly sets a different tone -- particularly things like manufacturing, where the export sector had been holding up pretty well." (Source: WSJ)

Ajay Rajadhyaksha, fixed income strategist at Barclays: "I think the market's going to be disappointed with what Fed does in September." (Expects 25bps)

Neptune (the planet not the god): (Note: it takes a satellite about 10 years to reach Neptune, luckily we knew all this would happen almost 10 years ago and sent the USS LoS to do the interview at that time, it just got back) "Well, fall-out from the sub-prime crisis has reached the outer limits of the solar system too. I myself am deeply underwater on 4 condos in Phoenix and I don't even want to talk about Io. Given that I'm a desolate and empty planet you would have thought it would be hard to get a loan for these speculative properties but I found it quite easy. Anyway I think it's important for the credibility of the fed that all these foolish dummy bankers and investors learn their lesson, if the fed bails them out, all of them will just go back to buying risky assets assuming that if something goes wrong the fed will fix it. Unfortunately for earth I don't think Bernanke will stick to his guns. Ok, have to go back to being freezing cold and lonely now, bye."

A common dragon on the street:*FIRE!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!*

Poseidon (the god not the movie): "If, as I have, you, mortal, had seen the ways in which the suboceanic mortgage crisis has ravaged the coral reefs as if Ares himself had taken his great axe to them, or the extent of the layoffs that have taken place at the shell exchanges, then you too would see the economic imperative of reducing the above-sea-level Fed Funds rate by at least 75 points of basis."

John Cusack: "I think they will do something. Ok, well, I'm hoping they do something. Note to the kids, never buy 75 spec houses in Las Vegas and Florida, even if you are a 'movie star.'"

Sauron: "My prediction is that [Bernanke] will look towards making one [cut], one [cut] to rule them all. This [rate cut] would cover all of Middle Earth in [a low interest rate]. This [rate cut] would allow the orcs to move across the land, and Mordor to dominate the realm of men."

Postmodernism: "The rate cut will be 50bps, on the nose."

30.8.07

Female Piratery or Female Lies?

CNN is running a story claiming a woman was the greatest pirate of all time. Based on what we know about women and investing, could this be possible?

CNN is running a story claiming a woman was the greatest pirate of all time. Based on what we know about women and investing, could this be possible?The article's claims are incredulistic. They say that Cheng I Sao (allegedly a chick's name fyi) "controlled a fleet of more than 1,500 ships and upwards of 80,000 sailors" and "expanded the scope of the business, branching out from simple attack-and-pillage jobs to protection schemes, blackmail, and extortion [and] set up an extensive spy network and developed economic ties with farmers who would supply her men with food."

Some known facts about women:

- They are bad at investing. Otherwise, I'd know more of them professionally, rather than just "professionally."

- They suck at cutlasses. Have you ever seen a woman successfully dominate someone with a cutlass. It just doesn't happen.

- They cannot hold their rum. Try this out at home with a female you know, forcing them to take down 1 part rum for every 1 part you take down. The results will surprise and please you.

- They do not have peg legs or eye patches. Again, a quick survey of your female "friends" will show this to be the case

Now we checked the article and it did mention several times "she" but the most logical conclusion is that they misunderstood Chinese (we are fluent in both oral Mandarin and written Cantonese) and confused Cheng I Sao's gender accordingly.

Consider this clear evidence that Cheng I Sao was a very savvy and very male investor:

Cheng I Sao's most famous laws applied to the taking of female prisoners. Ugly women were returned to shore, free of charge. Attractive captives were auctioned off to the crew, unless a pirate personally purchased the captive, in which case they were considered married.

Recommendation: We maintain a "Do not buy" rating on piratery, after calling the top perfectly last year. While fundamentals are improving, there is continued risk that a global economic downturn would impact the richness of pillaging shipping lanes and destroy the return on capital invested in piratery machinery and assets.

18.8.07

Bernanke in Pictures

Hi, my name is Ben. I am in charge of the economy, more or less. To my left, a man far less important. To my right, Greenspan. Last night, the three of us held a secret meeting in our hidden Fed safehouse. There we drank, ate, told some amazing jokes and then decided to cut the Fed Discount Rate 50 basis points.

The rate cut was approximately this big. The technical issue as to what the Discount Rate actually means is largely irrelevant -- the takeaway for you is that we cut a Rate 50 bips. Does that make you happy?

I knew it would make you happy. It made me happy too, that's why I did it. Some have concerns that this is a ham-handed intervention into a free market and worse, a temporary salve, that will give people a delusional sense of comfort. These are really good points, so let's switch to a profile shot.

As I mentioned above, I am in charge of the economy, more or less. And the economy, more or less, is the stock market. As you can see there is nothing temporary about today's bump in the DJIA. Also did I mention that the Rate cut was this big?

17.8.07

On Liquidating Your PA

Contact your broker and say "Sell! Sell! Sell!"

Don't:

Contact your broker and say "Buy! Buy! Buy!". This will lead to liquidation, especially if your account is of the margin variety, but it will take a few more weeks and involve having no money left.

Do:

Wear a whale belt. Let the market know you still feel Nantucket, even if deep inside you know you are Jersey Shore now that the market's scythe has reaped what you have sown.

Don't:

Drink heavily. Yet. There will be plenty of time come Friday to reenact The Lost Weekend. The drugs don't work, but the sauce does.

Do:

Invest your new newly found liquidity in sexy parties. Sexy parties are one of very few assets with no-downside

Don't:

Invest your money in stocks, bonds, phantom bonds, subprime mortgages, hedge funds, put options, call options, securities, US dollars, New Zealand dollars, Renminbi, currencies, real estate, gold, commodities.

Do:

Yell. Primal screaming has proven therapeutic effects. We read this on the internet.

Don't:

Worry. Now that you aren't invested in the markets, they can only go up.

Possibly Fake but very Full Disclosure: I own nothing

16.8.07

The Jitters

Guy #2: Subprime?

Guy #1: Subprime.

Guy #2: Jitters.

Guy #1: Exposure?

Guy #2: Subprime Jitters.

Guy #1: INFLATION.

Guy #2: No, CONTAGION.

Guy #1: But the expected loss on all residential subprime loans is de minimis to the greater economy.

Guy #2: Liquidity. And contagion.

Guy #1: Oh. Fuck.

Guy #2: Commercial paper.

Guy #1: The end.

15.8.07

Cerberus: Den of Mini-Ballers or of Satan?

Some choice quotes:

But then, Feinberg is not trying to win a popularity contest.No shit, really?

There is little at the office to distract staffers from the business at hand—almost no art on the walls, no fancy woodwork. “It’s not a place you bring clients to impress them,” says a former employee, who adds that those in the satellite offices refer to headquarters as the Death Star.

“His ego is having no ego.”Do real people say things like this about people? Have you ever thought about one of your colleagues or friends something along these lines? "He has an 800lb gorilla on his back, and its the desire to make money for his clients." Do Business rags just make this up?

“Steve didn’t care. He was a get-it-done person, and he wanted to get it done.”Mini-baller?

They named their new company after the three-headed dog that guards the gates of hell in Greek mythology. The company has long held that the symbolism refers to the fact that one eye is always open, presumably protecting investors’ money.The symbolism refers also to the fact that Cerberus Capital Management serves at Hell's pleasure.

Recommendation: We recommend a Steve pair trade -- long Feinberg, short Schwarzmann, a bet on Stevevergence. Feinberg may be a "get-it-done" person, but minions of the dark lord are excluded from mini-baller status. (Aside to Portfolio, how could you not mention Cerberus deals which aren't getting gone? Or are they getting done?)

7.8.07

How to Say All Their Money is Gone - Part II

Last week you received a letter from the head of Long or Short Capital Management, Mr Juggles. In this letter Mr. Juggles told you that although your money was invested wisely according to the prospectus, that money has subsequently disappeared. We wanted to write you to let you know that after further diligence this is 100% accurate. Your money is definitely, definitely gone, for sure.

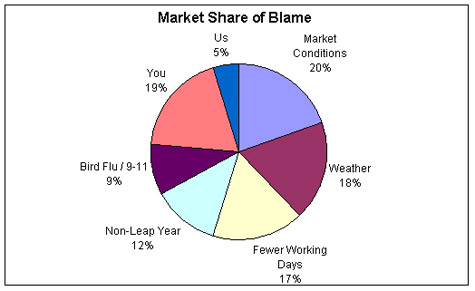

The feedback we received on the previous letter has revealed that you are unhappy that your money is gone but you were especially upset with our refusal to accept responsibility for your money being gone. Well first we would like to remind all of our valued clients that you shouldn't point fingers. This is not just your fault, it's everyone's fault. Even ours, just to a much lesser degree than it is yours( especially important point for you to take away). We have completed a detailed and rigorous analysis of whose fault it is and thought it was important to share the results:

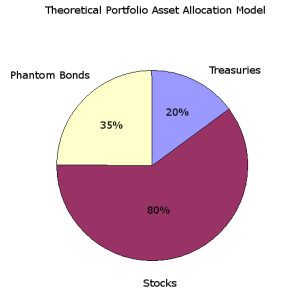

The chart depicts graphically the small size of our fault. After further study it was determined that all of our market share of the fault stems from one person: Mr. Juggles. As of this morning we have resigned him. Kaiser Edamame, our Germo-Japo restructuring expert and portfolio manager of our anti-union humor portfolio, will take-over for Mr. Juggles effective immediately.

We have also implemented several restructuring measures to ensure that when your money disappears in the future, it is less our fault than it was this time. Starting on August 30th, before we invest in low-yield, illiquid securities with high default risk we promise to "think-twice". This represents a 100% increase in the amount of thinking we have done in the past. Also, in the case of our most risky investments, before we increase our exposure to them we will now "sleep on it," something we have not done previously. We feel confident that these measures will significantly increase your returns and hence our fees over time.

Please contact me with any questions.

Subprimely,

Johnny Debacle

EVP Long or Short Capital Managment

1.8.07

How to Say All Their Money is Gone

As you may know, the investment process has a normal course. Generally accepted investing practices follows that you, the investor, give us, the manager, money. As manager we take that money and buy something with it. This something generates profits and at the end of the year, we pay ourselves some percentage of what we bought with your money, as well as some percentage of the generated profits. Everyone profits which is a good thing.

Unfortunately, the money you gave us did not follow this normal course. Per usual, we "invested" your money in tranches of CDOs comprised solely of loans to people who specifically would never be able to pay down their mortgage. Their inability to pay was the very thing that made these such great loans and allowed us to demonstrate to you a profitable two year record of performance. This could have continued but your money decided to disappear.

As far as we can tell, there is no current record that points to existence of your money. It's no longer part of our assets under management. Look, it's up to you how you raise your money and I don't want to get into a nature vs nurture sidebar with you, our valued client. But don't you think that maybe you should have imbued your money with more of a sense of sticktuitiveness? I mean, it literally seems to have vanished at the worst possible time, what with the depressed prices and attractive yields which now litter our market. This is when we could be printing profits for you (if only your money hadn't disappeared).

I guess, for us, we're disappointed in you. Your role is to let us take your money, assume none of the risk and allow us to give you some of the return. Don't you see how this relationship breaks down if you allow your money to disappear? We're not angry with you, just disappointed. It's your loss, as we still earned our management fee, it just seems like a waste for you.

I have enormous confidence in Long or Short Capital management and the ability of our talented professionals to bring you the highest quality products and services now and in the future as they have in the past. You can count on us to deliver...if you don't let your money vanish.

Sincerely,

Mister Juggles

Related: PDF of Bear Stearns Asset Management Letter via Dealbreaker.

27.7.07

Stocks Stocks Stocks: A Week in Review July 27th

KKR (Sorta listed in like Amsterdam or some shit): Jealously eyeing Blackstone because they were able to pull off their IPO at a peak.

Market Impact -75

Blackstone (NYSE:BX): Jealously eyeing KKR because they were unable to pull off their IPO and thus are not exposed to the judgement of the plebes.

Market Impact -100

Every other PE firm -- Jealously eyeing KKR and Blackstone for being incrementally more prestigious than they.

Market Impact -300

Chevron (NYSE: CVX): Chevron continued investing in production facilities for it's "Blind Faith" field in the Gulf of Mexico. First drilled in 2005 there is little to no evidence that oil reserves will be discovered. When asked why the company was spending so aggressively on this speculative field they responded "Go ahead, don't believe us, that sure worked out well for Doubting Thomas didn't it? Just because you can't see the oil doesn't mean there isn't any, that's what faith IS, duh".

Market Impact -20

The Actual Economy: Hey guys, I'm doing great! Why y'all look so glum?

Market Impact -400

25.7.07

The Ring of Greenspan

Swiftly I laid the ring of Greenspan on a stone I had placed in readiness, and broke the dark jewel with a blow of the Hewlett-Packard financial calculator which I carried. From the pieces of the lightly shattered gem, the disemprisoned demon rose in the form of a smoky fire, small as a candle-flame at first, and greatening to a spinning inferno. Hissing softly with the voice of fire, and brightening to a wrathful, terrible gold, Greenspan leapt forward to do battle with Subprime Exposure, as he had promised me, in return for his freedom after cycles of captivity.

Greenspan closed upon the Subprime Exposure with a vengeful flaring, and it relinquished our structured product, writhing like a stern bear struck by a cannon. The body of the Subprime Exposure convulsed loathfully , and it seemed to melt in the manner of wax, changing horribly beneath the flame as it undertook an incredible metamorphosis. Moment by moment, the thing took on the wavering similitude of man.

The unclean blackness swirled, assuming the weft of cloth amid its changes, and becoming the folds of a dark suit such as worn by a government official or conservative business executive. Then, above the cravatte, a face began to peer. The face, though shadowy and distorted, was that of Bernanke. The fire-shaped Greenspan assailed the abhorrently transfigured thing, and the face melted again into waxy blackness, and a great column of sooty smoke arose, followed by an odor of burning flesh. And out of the volumed smoke, above the hissing of Greenspan, there came a single cry in the voice of Bernanke.

18.7.07

Zimbambwenomics and Mugabe Efficiency Theory

Supply and demand is the bedrock of economics, the balance of which ensures cosmic order and more importantly, efficient allocation of scarce resources. But the problem with supply and demand is that sometimes the demand cannot afford the supply. This is where Mugabe Efficiency Theory comes in. In it, when supply is too dear, government fiat is needed to make it priced where demand can buy it. Problem solved, supply and demand clearly balanced and the cosmos is once again in order.

Supply and demand is the bedrock of economics, the balance of which ensures cosmic order and more importantly, efficient allocation of scarce resources. But the problem with supply and demand is that sometimes the demand cannot afford the supply. This is where Mugabe Efficiency Theory comes in. In it, when supply is too dear, government fiat is needed to make it priced where demand can buy it. Problem solved, supply and demand clearly balanced and the cosmos is once again in order.Zimbabweans are shopping like there's no tomorrow. [In] the aisles of Harare's electrical shops,...the widescreen TVs were the first things to go, for as little as £20. Across the country, shoes, clothes, toiletries and different kinds of food were all swept from the shelves as a nation with the world's fastest...economy gorged itself on one last spending spree.

Car dealers said...that a car costing £15,000 could be had for £30[.]

President Robert Mugabe's order that all shop prices be cut by at least half, and sometimes several times more, has forced stores to open to hordes of customers waving thick blocks of...money given new value by the price cuts. The police and groups of ruling party supporters could be seen leading the charge for a bargain.

...

The impact of the price cuts was felt almost immediately as fuel virtually disappeared from sale after garages were forced to sell petrol for 23p a litre, less than they paid the state-owned supplier.

The so-called "charge for a bargain" is exactly the kind of thing that will stimulate demand into consuming supply and ensure the economy is in a Mugabe Optimal state. If demand could not afford the supply, then the universe would probably implode making Mugabe Efficiency an important policy issue for all those who would prefer for existence to continue.

Economists say the price cuts will only deepen the national crisis, leaving many shops bare because they will not be able to afford to restock while official retail prices remain lower than the cost of buying wholesale or importing. Mr Mugabe has dismissed such warnings as "bookish economics".

Recommendation: We see no downside to Mugabe Efficiency Theory. If things are made more affordable by force, then more people can and will buy them. This will in turn grow the economy and spur production of....uhm....uhhhh...hmmm

HT to the undervalued Newmark's Door.

11.7.07

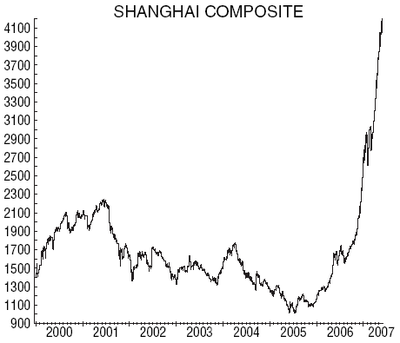

China Does Get It

What separates China from the rest of the world? Accountability.

What separates China from the rest of the world? Accountability.China's former top food and drug regulator was executed Tuesday after his conviction on corruption charges, state-run news media said.

Zheng Xiaoyu, 62 years old, was given the death penalty on May 29 after being found guilty by a Beijing court on charges of taking bribes and dereliction of duty. Mr. Zheng, the former director of China's State Food and Drug Administration, appealed the verdict last month, but a higher court upheld it and the execution was approved by China's Supreme People's Court, according to Xinhua News Agency, which reported the news.

...

Mr. Zheng and other past SFDA officials were accused of accepting bribes in return for approving the sale and distribution of drugs. This past weekend, the SFDA said it had suspended the sale of a drug widely used to treat leukemia and other cancers after a number of patients suffered adverse reactions.

In the US, Secretary of Homeland Secretary Michael Chertoff still has his post despite overseeing FEMA during the disastrous handling of the Katrina aftermath. Iraq has been a debacle but Rummy resigned without being fired, and -- as far as we know -- is still standing. Former CEO of Home Depot (NYSE: HD), Robert Nardelli, oversaw a half dozen years of stock price stagnation and walked away alive with hundreds of millions in cash money.

Does the US really get it any more? I mean besides our high standards of living, long life expectancy and unparalleled freedom --things which only matter to theorists, liberals and puppy dogs. Does the US get it?

In China, the state would have culled the bottom 10% and sprinkled their remnants into Meow Mix so that Western cats would feast on soy-meal based bits of their under-performing souls. That is accountability.

If there was a chance that your performance review would end with your execution, you (even Canadians) would be motivated to effect the kind of growth the Chinese have been able to wring out of their rice paddies and toy factories the last 23 quarters or years or whatever.

And just to demonstrate that you can't be too cruel:

Another former SFDA official convicted on corruption charges was given a suspended death sentence Friday.

A suspended death sentence is a signal to the People to let them know that while Big Boss expects a lot, he is willing to show some mercy.

Recommendation: China gets how to set a tone and stick to it. This is why when the squids take over, China will be their no.2.

8.6.07

If Only Water Wasn't So Fattening

Recommendation: Formulated with a unique mix of nothing at all, Diet Water is a compelling sell to health conscious consumers who are weary of being force-fed waters that aren't not dripping with no calories. Now they have a healthy alternative that allows them to consume as much water as they want without gaining any weight. Long diet water. Porkers and women will buy anything, even if it's nothing. In fact, they will frequently pay a premium for products with high levels of nothing content.

7.6.07

I'm Calling the Top. My ten signs:

- Shares of Odyssey Marine Corporation (NYSE: OMR) recently doubled when they announced they found sunken treasure.

- Microsoft (NASDAQ: MSFT) (supposedly smart people) paid 38x EBITDA for a company that has half its earnings from a product that Google will probably offer for free.

- Sotheby's (NYSE: BID) stock price has predicted the last two recessions and is predicting another any second:

- Dog Yoga

- Shares of the Berlin Zoo (BBERG: ZOO.GR) recently doubled due to the birth of a baby polar bear named "Knut".

- Private Equity firms in search of stable cash flows are buying Qantas and Iberia - they are airlines. In case you've been dead for the last 50 years, airlines are not in the steady cash flow business.

- Blackstone, a company built on the advantages of private vs public ownership, is going public.

- Actual NYTimes headline: "At Cannes This Year, the Bankers May Outnumber the Movie Stars"

- Michelangelo Volpi left his position as the head of an $11 billion division of Cisco (NASDAQ: CSCO) to become the CEO of startup Joost, which just raised $45mm of VC funding. And he isn't crazy since Joost will likely be acquired for $40 billion in 2 months, or roughly 5 billion times revenue or negative 30 million times their projected 2010 cash flow.

- Chinese solar company LDK Solar traded down after its IPO. That was a disappointment since two weeks ago China Sunergy shot up 51% after its IPO. In fact, there have been 9 solar-cell IPOs since Dec05 with yet another -- Yingli Green Energy Holding -- coming this week. Point of interest: LDK's CEO was a shoe salesman 5yrs ago. Today he is worth roughly $1bn.

Addendum: Ours go to 11.

11. China.

11.5.07

Vertizontal Consolidation

- Bang’s ambulance service

- Bang’s funeral home

- Bang’s sausage manufacturing plant

Recommendation: We have already documented the surging "willing-to-consume-feces" demo," but now that demo has one-upped itself as if to say "excrement is nothing -- we’ll pay to eat our own relatives (provided that our relatives are both cheap and delicious." And Bang’s ambulance/funeral/sausage is there to reap the profits. Right now, I really like any business plan that is based on ruthlessly taking advantage of the American public's willingess to eat anything which is both cheap and delicious.

21.4.07

Dogs Can Smell Fake DVD’s and Other Malaysian Lies

The AP is reporting that the Motion Picture Association of America has trained two labradors to sniff out pirated DVD's. The dogs are named Lucky and Flo and they have reportedly help uncover 1.2 million pirated DVDs. As a result of this dog-gone amazing success:

The AP is reporting that the Motion Picture Association of America has trained two labradors to sniff out pirated DVD's. The dogs are named Lucky and Flo and they have reportedly help uncover 1.2 million pirated DVDs. As a result of this dog-gone amazing success:Malaysian movie pirates have placed bounties on Lucky and Flo who have so far helped uncover $3.5million in fake CDs and DVDs during raids on warehouses....Theblack Labradors will participate in more Malaysian raids, but they also could be deployed to other countries for anti-piracy operations from time to time, Gane said. He declined to identify which countries were being considered, citing security. Lucky and Flo are the world's only dogs trained to detect a chemical used in making discs, the MPAA has said.

I call bullsh-t. Bullsh-t. Bullsh-t. Bullsh-t. They are not the only ones. I recently trained my dog to smell forged signatures - now he sits at the bank teller and barks whenever someone tries to endorse a check that's not theirs. He is the only dog in the world trained to smell a chemical used in forged signatures. He has put an end to identity fraud in New York City and he may be deployed to other cities which shall remain nameless for security reasons. He has a bounty and a blue bow on his head. Also he can smell fake orgasms, which was why I got rid of him in the first place.

Recommendation: Short lies and bullsh-t.

15.4.07

Make Emissions Delicious, Stop Global Warming

There is a consensus that global warming is a problem; not debatable.

There is a consensus that global warming is a problem; not debatable. There is a consensus that there is the potential that the magnitude of the problem will be ginormous; not debatable (the cause, the extent and the likelihood of this potential are all very debatable).

But there is no consensus on the solutions proposed, most of which have more holes than our own ozone (Kyoto), are as of yet unproven (carbon credit trading) or are downright scams (those firms like like Terrapass which allow you to "offset the carbon emissions of your car" by PAYING THEM to invest in renewable energy sources or planting trees and crap. Note to the world: you and the rest of the world are likely better off just picking a random publicly listed clean tech pureplay and sticking all your ROTH IRA moneys into it rather than filtering it through these toll collecting middle men. This is the same scam as Fair Trade. And your part in global warming is only slightly played by driving cars, as the bulk of your contribution to the problem comes indirectly from actions you take.).

This is when I use facts.

Fact: There are more people everyday.

Fact: More greenhouse gases enter the atmosphere everyday.

Fact: People need to eat.

Fact: Greenhouse gases may lead to global warming.

Solution: Make greenhouse gases more delicious.

If carbon emissions were delicious, people would eat them, and they would either disappear (the gases not the people) or be processed into harmless byproducts based on science. Despite this obvious solution, there is not one research scientist whom we uncovered in our digging who is working on a way to make carbon emissions delicious. And it's even worse than that. The millions of hungry mouth which are added to the world every week don't demand delicious edible exhaust; they would almost certainly settle for edible exhaust, a much easier bar to clear for any potential edible exhaust innovator.

Recommendation: In the current climate, there is a real opportunity for a company which is bold enough to place an R&D bet on the nascent "Clean Plate Tech" industry. But more that, for anyone with capital and a conscience, this is also a way to dollar vote for a better future, for your children and your children's children. It is a financial moral imperative to get this done.

20.3.07

The Market, She's a Bitch

In many roles that have been traditionally dominated by men, the underlying structure of a given profession is often personified as a woman. The best example I can think of is that of a sea captain: both the ship and the ocean are almost always described as a woman. Mother Earth yields crops to farmers; look to Greek mythology to find the goddesses of Spring and the Harvest. A rejoinder to this observation is the stock market. I have never heard a trader or an equity analyst (during my employment at a sell-side firm) refer to the market as a woman. Indeed the stock market is almost always given the genderless pronoun "it" in both common and academic conversation.

I, however, firmly believe that the market is a woman, and I believe the most recent sell-off gives support to my argument. On February 27th, the market behaved exactly as a woman would in a similar situation. In bed.

Over the trailing trading sessions, the market was getting nailed – in a good way – and she was really enjoying it. Point by point, rising closer and closer to double digit returns. Coherent thought was miles away as she slipped deeper into a state of upward momentum. Rising. Higher. Higher. It seemed like the pure joy would never end. But was there risk? Globalization and transparent markets had mitigated all need for protection, so on she went. Closer and closer to the peak of 52-week highs.

Then, as if fate itself called down to her, she realized she had forgotten to take her birth control and she was not "this kind of girl". She was overexposed to sub-prime debt. The market went from legs-wide-open to frigidity in less time than it takes a fixed income trader to eat his Atkins lunch. And when the market closed, investors had to go to bed pissed off and feeling like they got kicked in the nuts.

Don’t worry, though. She'll be back.

3.3.07

Crazy Person or Bluetooth Headset? The Home Game

Hence Crazy Person or Bluetooth Headset.

This morning I was treated to two such travelers, allowing for two rounds of CPBH.

Round 1:

Man in his early 30's, nattily dressed but in a casual fashion. Dark curly hair a little bit unkempt but not overly so. He sat on the train having this conversation with open space: "Father, you are up. It's good to hear that [laughing a little crazily]." He continued but was cut-off by a cloud of people and background noise. Was he crazy or just bluetooth equipped?

Crazy person!

Round 2:

Asian man on the street, in a normal looking coat, mid-40's gesticulating wildly while screaming things in Chinese or whatever. But his hair gave him away. Too well-coiffed to be a crazy person.

Bluetooth Headset!

In business flight terminals, you can play the sister game Bluetooth Headset and/or Total D-Bag.

1.3.07

Jacob, Son of Isaac, the First Value Investor

LoS: Hi Jacob

Jacob: Shalom

LoS: How did you get into value investing?

Jacob: Well I have to say it started at birth. Actually that's wrong, it started at my twin brother Esau's birth. You see he was born first and by his birthright had claim to my father's estate. He was stronger than I was so I knew even in my mother's womb that he would probably push his way out before me. Right from the start I realized I wouldn't be handed anything in life and would have to make my own way. I saw value investing as the best way to do that. I think recognizing my value bias while still in the womb has been key to my success.

LoS: Tell us about your first deep value pick

Jacob: My early career was unique in that I really only monitored one asset: my brother's inheritence (NYSE: MBI). Having watched it my whole career I was well prepared when MBI fell out of favor with the street, at the time I thought the market in general was over-valued so I was holding a large portion of my assets in the "cash" of the day which was actually just soup. The largest holder of MBI, my brother Esau, always had a Food-At-a-Reasonable-Price bias (FARP). He was tired of waiting for the intrinsic value of MBI to be realized by the market, and he was hungry and wanted some soup. I saw an opportunity to buy MBI at 0.003% of intrinsic value so I sold my soup "and the rest is Old Testament" as they say.

LoS: That's impressive, what are your best ideas now?

Jacob: Sorry but I never discuss my current portfolio, you never know when someone might dress up in wool and trick you into bequeathing your fortune to him. Or dress his ugly daughter up to look like his hot daughter and have you end up marrying the wrong one. I do have some advice for young investors though: Don't live until you're 180. It's much easier to have lifetime 20% returns if you die at 75.

LoS: Great point Jacob - thanks for your time. Next week Noah tells us how one contrarian bet on weather futures changed his life forever.

17.2.07

Adjusted GPA on a Pro Forma Basis

Say you are an investment banker at a large Wall Street Firm, like Silverman Sachs or Layman Brothers, and you are trying to syndicate Theoretical FCF Corp's bonds. The problem is that Theoretical FCF Corp seems to lack any actual cash flow and will almost certainly never actually pay down any debt. What do you do? Just pro forma their EBITDA to what their cash flow would be if they actually generated cash flow, as you kinda expect they may sometime in the future. And if that doesn't get your bond customers to a number that makes them want to write big tickets, adjust that number for "one-time" expenses like "bad debt", "restructuring charges" or the vague but powerful "fees". This is how you get it done when syndicating debt or selling IPOs.

Now for a student, their GPA is basically the equivalent of a firm's 4 year trailing cash flows. The number itself carries huge weight in job interviews, yet for decades students have reported GPA exactly as it appears on their transcript. While entirely accurate, this is a huge mistake. Job applicants are now realizing that adjusting their GPAs can give a more accurate misrepresentation of their performance and expected future production.

Why should an employer hire an average of you over the last four years, when what they should be interested is a real misrepresentation of what you could be now if not for certain events? Here are some ways students are making themselves look better on paper:

- Add-Backs for non-recurring GPA deductions, such as getting drunk at a final, or anything that happened freshman year

- Pro forma GPA for dating someone smart or at least someone who wears glasses in the morning.

- Projected GPA levels for future years using the same class load. Surely a student would be more efficient in those classes if the student took them again. Thus the student should adjust their GPA to better match their future production.

- And the most common move, arbitrarily making their GPA a 3.6 - good enough to get by, but not good enough to raise suspicion.

Recommendation: If you are serious about a job in finance, it's important to signal that "you get it" before you even arrive. We heartily endorse the use of adjusted and PF GPAs for this reason. Remember, it's not what you did or will do, but what you can convince people you did or will do.

14.2.07

Pomegranate Capital Thinks Women Can Run Money Better, Is Wrong

Susan Solovay, a woman by trade, has started a fund of funds whose mandate will be to invest only in hedge funds run by women. Solovay is marketing this FoF on the claim that women manage investments better than men. (quotes from Business):

Susan Solovay, a woman by trade, has started a fund of funds whose mandate will be to invest only in hedge funds run by women. Solovay is marketing this FoF on the claim that women manage investments better than men. (quotes from Business):Solovay commissioned extensive academic research into the performance of hedge funds run by women and claims that it showed that women fund managers performed consistently better than those run by men.

Other examples of commissioned "academic research" show that:

- Cigarettes taste great and are healthy

- Lead is perfectly safe for the lining of our water pipes

- Corn based ethanol makes any sense whatsoever for reasons other than padding the pockets of Archer-Daniels-Midland (NYSE: ADM) and making idiots feel better (wrongly) about the environment

She claims that the research showed that male-run hedge funds managers tended to shoot from the hip making big returns one year and poor ones the next.

So what Susan Solovay is saying is that the men she has been with have not had consistently "big enough" returns. In this case size does matter and obviously Solovay has not invested in Long or Short Capital. Along with our investment strategy of "not losing money", we use the tactic of "making returns so big that the next year we can lose as much as we want, whenever we want".

For non-abstract financial advisors and managers, performance problems are understandable and not infrequent. But these problems are not due to male analysts and portfolio managers alone. Women are involved in these funds too. If not where would the coffee come from? Who would do some of the back office functions and the bulk of secretarial work? And who would provide massages to male analysts and male PMs? And how would any large investment manager be able to adequately staff their investor relations department? Women are part of the performance of these funds and it is sexist to abdicate them from responsibility just because they are never put in positions to drive actual investment decisions or because nobody takes them seriously.

Recommendation: Setting aside my qualms about Ms. Solovay's rampant sexism, Pomegranate Capital seems to be a dubious gimmick. As an investor, you have two layers of fees and you have a restricted pool of PM talent.

LoS has witnessed the success of our Satan's Portfolio thesis against opposite minded strategies such as those embodied by PAX Fund and we see Pomegranate Capital as a similar opportunity. Although different in composition, we think a great play would be to go long the all-in return of the Vice Fund and short the all-in return of Pomengranate Capital, effectively creating a "PC spread" of sorts.

30.1.07

Four Simple Steps to Becoming a Thousandaire

- Go to college. Or not.

- Work a max of 40 hrs per week. Do not break this rule under any circumstances.

- Have kids with many women. Paying child support is fun.

- Treat yourself to a car you can't afford. Gas inefficiency is a plus.

- Remember that money which you save will probably be stolen by those crooks at the bank. Spend all your money now to avoid future losses.

13.1.07

Joe Theismann Presents Monday Morning Investing

Joe Theismann:

"I'm gonna tell you something. Warren Buffett knows that value investing wins championships; no team can succeed in post-season investing without having a strong 'going long' strategy. We had the opportunity to talk to Buffett yesterday before the market opened, and he told us how important he thinks the long game is to investing and he told us how he built his entire empire on it. Establishing the long keeps the market guessing, and allows investors to win big returns. Once an investor has established the long game against the market, the experienced investor can call for play-action shorts leaving the market expecting the long up until the transaction is complete, then running a short trade. So the key to Buffett investing is always going long except when you're going short.

We also had the chance to catch up with Bill Miller last week during training camp. He told us that he has always focused on investing in stocks that go up and avoiding stocks that go down. Whenever he looks at a company, he tries to figure out whether that company is going to make money, even before he makes an investment. That type of hard work, strategy, and dedication explains why he's a star. But the thing about Bill Miller that really seperates him apart is that he is also a tremendous person."

Theismann referred us to his former Sunday Night Football boothmate, Paul Maguire, for technical commentary.

Paul Maguire: [Ed: Maguire used a Bloomberg machine to perform his trademark telestrator analysis.]

"Now I'm gonna show you something, LOOK AT THIS CHART RIGHT HERE, see that line, watch that line, see how it traces up, now look at this, the shape it's forming, look at that line, here, and there, look at it...BAAMMM! That's a nice formation. Now I'm gonna show you how that line connects at this point HERE, look at that and forms with those lines over there, watch this, look at this, watch this, LOOK, now what that means is that you watch this, right here is where you are going to want to short. And that's how investing is played."

15.12.06

My Refrigerator Accounting

11/12/06: Sir Equity Go (Me), in a bold reorganization of his food production and consumption process, has announced plans to initiate a Just-in-Time inventory system. The practical application of this shift will require Sir Equity to eat only take-out Chinese food for every meal. While this will streamline his inventory system, it will also likely increase his W/H ratio (Weight/Height) substantially.

1.12.06

2x2 Matrix: Less & More

It turns out that any media business can be described by two variables: the amount of product, information, or entertainment being produced [referred to hereafter as Strategy] and the resulting value creation. The key question for each company is to look at each of these two critical valuables and ask: Less or More?

Google: More is More

Strategy: MORE. Google (NASDAQ: GOOG) is producing more of everything. After originally launching in search only, Google now provides email, maps, IM, photo management, and online videos of trivialities (via the YouTube acquisition).

Value: MORE. Google now has a gazillion dollar market cap.

Yahoo: More is Less

Strategy: MORE. Yahoo (NASDAQ: YHOO) has the #1 portal, #1 email service, #1 prescence in the key Asia market, and leading positions in pretty much every other vertical. They are also -- like Google -- investing tons of money in servers to make their services speedier and have recently acquired many interesting companies.

Value: LESS. Despite the great assets involved, Yahoo is run by a man who has a hard time speaking the English language, whose daughter has starred in a reality show about spoiled kids, and who doesn't know how to use email. As a result, MORE becomes LESS.

Clear Channel: Less is More

Strategy: LESS. In late 2004, Clear Channel (NYSE: CCU) embarked on a bold plan (incredibly) titled Less is More. The stated goal of this plan was to reduce the amount of "clutter" (i.e., ad units) per hour on its radio stations in order to boost listening. The super secret goal was to push advertisers from 60 second commercials to the more expensive 30 and 15 second ad formats. This program appears to have been at least modestly successful due to a significant year over year decline in sucktitude at Clear Channel radio stations.

Value: MORE. Clear Channel's stock has recently rallied and management has accepted a buyout offer from private equity firms. Including the 2005 spin-outs of Live Nation (NYSE: LYV) and Clear Channel Outdoor (NYSE: CCO), Clear Channel shareholders have done pretty well for themselves since the Less is More strategy was implemented.

Newspapers: Less is Less

Strategy: LESS. Newspapers are reducing everything in sight including: employees, subscribers, revenues, reporting staff, and even the physical size of the newspapers. In fact, they have cut everything except their margins...a fact which has prevented them from reinvesting in growth areas like they should be. In short, they are screwed.

Value: LESS. Newspaper stocks go down every day.

17.11.06

Critical Mass Supplier

MySpace was bought by Fox (NYSE: NWS) last year for $580mm. Youtube was recently bought by Google (NASD: GOOG) for $1.6bn. Plenty of Fish is pulling $5-10mm per year in topline with a guy, his gf and a couple of servers in their basement. eBay (NASD: EBAY) plods along without having done anything new in half a dozen years, basically living off it, while Friendster had it, and then failed to detonate it at the right time. None of these entities offer anything that can't be or hasn't been replicated by dozens of pretenders and assorted Indians in Bangalore.

What is the key ingredient these successes have which the failures strewn on the road behind them lack? Critical mass.

The best way to make money in today's world bar none would be to become a supplier of critical mass. Companies thrive on reaching the point at which they have such a base of customers that use their services that their services become an order of magnitude more valuable to every marginal customer than their competitors' services which lack critical mass. So why not supply this input which is so crucial to success?

- Fact: Most ideas hinge upon "getting critical mass." For most business models this is achieved in the 18th month of projections, or the Null Set month of reality. This ensures that demand would be high.

- Fact: Critical mass is cheap to manufacture, requiring only one critical mass machine based on a shifting flywheel design, no associated ongoing capex, no labor, no operating costs. This insures that the cost would be low.

- Fact: Critical mass is an intangible if not entirely asbtract concept. This ensures that achievable supply may be infinite (or non-existent).

Recommendation: Supplying critical mass is an extremely attractive business due to the high demand (no substitutes, mission critical input), low fixed costs, and marginal costs of zero. The key to becoming an effective supplier of critical mass is getting large enough that everyone will go to you as a supplier of critical mass. We expect that after building your own critical mass machine or using the design we depict above, this would happen roughly 18 months into the life of your startup firm.

6.10.06

Molybdenum, the Sasquatch Metal

I allege that much like the sasquatch, molybdenum does not, in fact, even exist.

Points Which Point to the Non-Existence of Molybdenum:

- Has anyone ever touched molybdenum? Or seen it? I've seen or touched platinum, silver, gold and most metals, except uranium which I am willing to take on faith. I've never met anyone who had a molybdenum cufflink or a a ring with a molybdenum setting.

- Molyjhkldjaslkdjaslkd. Not a name you would give to a real substance, much less a metal. It seems like an inside joke about Molly B's Denim. Who is this Molly B? And where are her denim dungarees?

- The price has gone up from $2 per pound up to over $40 in just a few years (currently in the mid-20's). It is clear as to why the market hasn't corrected itself -- it is difficult to bring on formerly uneconomic molybdenum mines or copper mining trailing operations (where molybdenum can allegedly be found) when molybdenum does not actually exist.

Recommendation: Per Mr. Juggles Investing Commandment 5b you must verify that that which you think exists in an investment, actually exists. The non-existence of molybdenum could prove a crushing blow to stocks of firms who allegedly mine the possibly fictional metal.

16.5.06

Diversification, a Euphemism for Crappy Investment Option

Linked from Going Private was this article on hedge fund and private equity shops investing in big budget movies. The second article I found while Googling a rationale for the existence of the catastophe bond .

The articles contained these excerpts respectively. 1st excerpt:

For its part, companies such as Virtual see Hollywood as a potentially lucrative place to diversify investment portfolios. And Virtual is pursing that strategy in a significant way, investing in Leonardo DiCaprio's "Blood Diamond," Brad Pitt's "The Assassination of Jesse James," and George Clooney's "The Good German."

......

As a result, Virtual covered about $125 million, or half of the $250 million it should cost to make and market "Poseidon" around the world. At the current rate of ticket sales, Virtual could end up with $75 million or so from "Poseidon" — meaning it could lose more than $50 million on the movie, said two people familiar with the film's finances. A Stark executive disputed that worst-case scenario and also said its Hollywood investments should not be judged on the domestic box office of one movie.

2nd excerpt:

Advantages of [catastrophe] bonds are that they are not closely linked with the stock market or economic conditions and offer significant attractions to investors. For example, for the same level of risk, investors can usually obtain a higher yield with CAT bonds relative to alternative investments. Another benefit is that the insurance risk securitization of CATs shows no correlation with equities or corporate bonds, meaning they'd provide a good diversification of risks.

I can provide some other investments that would provide attractive diversification for these companies -- the roulette wheel. Some secondary thoughts: If you have a proprietary algoritm that picks Poseidon as a likely hit, it's time to get a a new algoritm. Libor+230 is an insanely low risk premium for the chance of losing all your money if Mexico has an Earthquake in the next three years; to compare the market pricing for secured near investment grade debt is L+220. If a Mexican offered me that deal, I'd build a fence around him on the spot.

Read More

30.4.06

Quotes Entirely Relevant to Investing

-Hostile Trends, John P. Hussman, Ph.D.

More Investing Quotes

28.4.06

Long Beer Diplomacy

From the WSJ.

Anheuser-Busch has been a sponsor of the World Cup since 1986. And it didn't expect to find itself in this bind when it paid an estimated $80 million in 1998 for exclusive alcohol rights to the 2002 and 2006 World Cup tournaments...German newspapers were reporting that beer fans were furious about the prospect of drinking the American brew at the tournament...If Anheuser-Busch insisted on enforcing its exclusivity, it was clear it would annoy some Germans who wanted to drink German beer and generate bad publicity for the company.

So Anheuser officials undertook an unprecedented act of beer diplomacy. Tony Ponturo, Anheuser-Busch vice president of global media and sports marketing and the executive who signed the World Cup sponsorship deal...He proposed letting Bitburger [a chief competitor] sell its beer along with Bud at the stadiums and at some promotional events. In return, the American company would gain the right to use the name Bud, instead of just Anheuser-Busch, on billboards along the fields -- and visible to viewers watching on TV at home.

Read More

27.4.06

Long: Death Squad Start-ups

Start up costs are extraordinarily small, given the strength of the U.S. Dollar in the region and the low cost of critical hardware (RPGs, AK-47 models, etc.) many of which are...

Read More

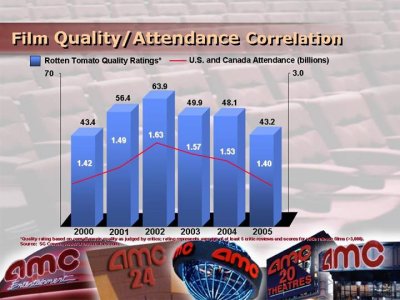

Rotten Tomatoes in Movie Theaters for RGC and CKEC

Read More

26.4.06

Smurfiest Smurf Investment Vacation Homes in Turkey

Smurf Village located in Akbuk Bay, Turkey, within 500 meters of the Aegean Sea.

There are five discreet reasons to invest in a vacation home within Smurf village:

...

Read More

If Excel was a Drug, I'd Sell it by the Gram

Read More

25.4.06

If Race Car Drives Have Corporate Sponsorships Why Don't Bankers?

It's all about eyeballs and disposable income, so why not place your advert in the areas where both are most concentrated?

The financial profession and its customers have more money than they know to do with, which is leading to private equity firms throwing billions to...

Read More

24.4.06

Why does Google Talk Make the letters "BP" Blue When You Type It?

Read More

The Big V, the Big C and the Big WTF

This context will not help you when faced with the Creepy V.

No, this is not an educational ad warning about the dangers of "vagina" to young men (which are plentiful) nor is it an ad for outsourcing child molestation to letters of the alphabet. The Creepy V is the avatar used to market Virgin's new Cancer Cover product which "can give you a cash lump sum to help you financially if you’re diagnosed with cancer in the future." I'm not a big believer in insurance...

Read More

23.4.06

Quotes Entirely Relevant to Investing

Harry Lime: You know, I never feel comfortable on these sort of things. Victims? Don't be melodramatic. Tell me. Would you really feel any pity if one of those dots stopped moving forever? If I offered you £20,000 for every dot that stopped, would you really, old man, tell me to keep my money, or would you calculate how many dots you could afford to spare? Free of income tax, old man. Free of income tax - the only way you can save money nowadays.

-From the movie version of Graham Greene's The Third Man:

More Investing Quotes

21.4.06

When You Know You've Been Shorted

Me: But I'm the only person on your Google Talk buddy list...

My GF: So how do I do that?

Recommendation: Market underweight me.

Read More

20.4.06

"Smith Barney, Why do you hate your customers?" A Play by JD

"For the customer, who doesn't enjoy high levels of service and has no respect for their money, Financial Management Account, by Smith Barney"

JD: I have a brokerage account with you. A relative used to work there and having a live broker helps for things like buying producers of Japanese toilets or Russian Petroleum on their native exchanges rather than illiquid domestic ADR's.

Smith Barney: Yes, I am a well-known, venerable brokerage house, built upon the philosophy that customers should be rich, have low expectations and a deep self-hatred...

Read More

19.4.06

Quotes Entirely Relevant to Investing

-Leo Tolstoy

More Investing Quotes

McDonald's Gets It

Read More

14.4.06

Short Coca-Cola Blak

My position is so short, it may actually go negative short, which would be a long and would be terrible for all. Just like this horrendous disgusting concoction from Hades. Coke with double the caffeine, half the carbs and infinitely more "rich coffee essence."

My position is so short, it may actually go negative short, which would be a long and would be terrible for all. Just like this horrendous disgusting concoction from Hades. Coke with double the caffeine, half the carbs and infinitely more "rich coffee essence."Just as a service to the Coca-Cola Company (KO) here are some other combinations which, if you care about your shareholders even a little, we recommend you should never combine.

- Mayonnaise, beer and walnuts.

- Corriander and Bette Middler...

Read More

13.4.06

Long Japanese Bathroom Technology

I suppose I should have been more specific, especially since US investors are typically skeptical that a toilet maker can sustain a $3.6bn market cap and a 37x P/E. To clarify and rectify my mistake, I hereby formally recommend a long position in...

Read More

12.4.06

I Will Teach You to Be Rich: Clean Tech Pure Play

Step 1: Find a hot sector

Investors often talk about the "rising tide" law of investing: better to own a mediocre company in a great sector than a great company in a terrible industry. When a sector gets hot, the crap often rises as fast (or faster) than the cream.

No sector is hotter right now than "CleanTech." How hot? Big name venture capitalists are now raising cleantech-only funds. Bush discusses clean energy in every address he makes. And solar power -- solar! have I gone back to the future? -- stocks like Evergreen Solar (ESLR) and SunPower (SPWR) are doubles coming out of their IPOs.

Step 2: Create a pure play

Investors love pure plays. When a sector is hot, they want as much exposure as possible. Take online advertising. Sure, News Corp (NWS-A) owns MySpace -- the fastest growing web site and community -- but you have to buy a whole bunch of newspaper, cable, and satellite TV assets too. The performance of those assets will drown out any positive developments at MySpace. Instead, investors clamor for stocks like Yahoo (YHOO) and Google (GOOG) ...they're pure plays.

So for cleantech, I will start a company from scratch to ensure it's a pure play.

Step 3...

Read More

It's Direktanlage Wednesday!

Comments must:

- Contain insider information that will let us reap fraudulent (and likely abstract) profits.

- Be highly illegal.

- Be sourced from a Croatian, German, Russian or someone of evil descent.

- Give guidance on alleged inside-trader Monika Vujovic...

Read More

11.4.06

Disruptive Jobs of the Past

"Deadwood" - Childish Games (2005) TV Episode (as Meiling Melancon) .... Chinese Slavewhore

If ever there was a disruptive industry, slavewhoring would have to be it. Back in the good old days, being a land (capital) owner meant you would have your labor done by your slaves and your sexual needs satisfied at the local whorehouse. This was just how it was done, and...

Read More

10.4.06

Quotes Entirely Relevant to Investing

"The job of a Russian man is to plant:

His house in the ground (sic).

His seed in a woman.

His neighbour in jail."

More Investing Quotes

7.4.06

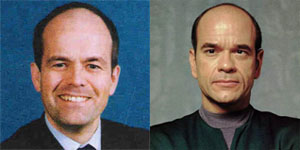

Short Dick Grasso

The Dick Grasso article clued in one of our staff who, on further investigation, has revealed that Mr. Grasso is also involved in the imposter scandal. Mr. Grasso has reportedly been taking fees for appearances at various Star Trek functions as "Arturus," a guest character on Star Trek Voyager played by Ray Wise...

Read More

6.4.06

Awkward Moments in Marketing

"When a girl starts menstruating, we want to be there...on the radio, in print, and on the web sites with relevant advertising."

From a very earnest, eager McKinsey consultant:

"Now we're focused on figuring out what it is about Metamucil that makes it so attractive."

Read More

5.4.06

Satan's Portfolio: MO, RMBS, DLM

- Altria (ticker: MO)

- Why would a $145bn market cap company change its name? If it's business was selling products to slowly kill its customers through addictive fire-lit tobacco. Satan knows that even that kind of mortal churn is capable of generating a stream of free cash flow to reward its stockholders. He also relates personally to the business strategy implicit behind the name change:

“They are trying to bury themselves. This is a name and brand the objective of which is to make themselves invisible.”

Invisible merchant of death. Play to the Dark One's ego, Altria, while selling your murderous and addictive maccaroni & cheese......

Read More

4.4.06

Biopiracy Downgraded to "Not At All Pirate Like"

Read More

3.4.06

Short Cocaine, Heroin, Microsoft

Increasing prices in Cocaine and other "A-List" narcotics have jump-started online disintermediation of street dealers and spawned...

Read More

2.4.06

Quotes Entirely Relevant to Investing Abraham Lincoln

-Abraham Lincoln

More Investing Quotes

30.3.06

A Letter to Our Shareholders: On Being Taken Over

Because we are happy in our cushy offices and enjoy our substantially over-inflated salaries and bonus plans ripe with inexorable options in a fictious stock...

Read More

Piratery on the Catwalk

It was only a few weeks ago, that we outlined that providers of pirate patches and clothing would benefit from the rising piratery tide. Now witness piratery on the catwalk...

It was only a few weeks ago, that we outlined that providers of pirate patches and clothing would benefit from the rising piratery tide. Now witness piratery on the catwalk...Read More

29.3.06

Tales from My Internecine Struggle with the IT Department

The monstrous IT guy remains motionless just ten feet away. Emotions give way to cognitive thought and I train my glare on him. Almost on cue, he begins his approach.

With blinding acceleration, he lurches onto me with a powerful "thud crackle". He slams into my chest. The impact is incredibly powerful, knocking the wind out of me. His huge arms envelope my complete upper body and I can feel my chest plate move as his beak grinds against it...

Read More

28.3.06

Carl Icahn is Blogging?

Read More

27.3.06

The Purchasing Powerless

Read More

26.3.06

Quotes Entirely Relevant to Investing Powerpoint

While you were making your [PowerPoint] slides, we would be killing you.

-Russian officer commenting to a US offier on who would have won if we had ever actually fought WWIII in Western Europe.

More Investing Quotes

24.3.06

Short: Mark Davison

Prosecutors allege that Mr. Davison has been supplementing his income (and failing to report it) via similar Star Trek convention gambits as recently uncovered by Long and Short with respect to Enron bad-guy/Star Trek android David Delainey...

Read More

23.3.06

Ask Julia About Your Length

Julia Mezzanine Tranche is an analyst at Long and Short, as well as a member of the Non-Certified Advice Columnists of America, the International Society of Bad Advice Columnists and Chairwoman of the Prestigious European Association for Paperclip Entrepeneurs and Analysts (PEAPEA).

Note: some letters may be "enhanced" for self-glorification.

Dear Julia:

Recently, Long or Short Capital's Johnny Debacle wrote an [interesting and dynamic piece on Phantom Bonds totally characteristic of the brilliant analysis that typifies Long or Short Capital]. He indicates:

If you have a 20 year plus horizon, then you probably want an allocation that is heavily weighted towards equity, say 90-100%. But you could supplement a 100% equity allocation with an incremental 20-30% of phantom bonds, without disrupting your asset allocation.

As I am 102 years old, my own horizon is somewhat shorter. Can you recommend some Phantom Bond allocations that might be better for my needs?

Signed,

I'm Dreadfully Hearing Impaired in Tiny Ithica, Texas.

Read More

22.3.06

JD's Lending No-No's #2 and #3

- Lending No-No #2a: Don't loan to companies who will need to control costs, if they have no connection to actual real world cost controlling.

Examples: - I was recently in an Italian city for a meeting. The company I was there to see indicated that the best way from the Aeroporto to the meeting was by taxi, so I trusted them and took a taxi. It was €80. I later found out that there was a €5 shuttle express that would have taken me with half a km of the meeting and would have taken about 10 minutes more. These are the people charged with cutting costs in a large industrial company that operates in a cyclical sector that saw several competitors file for bankruptcy only a few years ago.

Read More

21.3.06

How Not to Name Your Company

Read More

20.3.06

Appropriately Named Executives

- Lakshmi Mittal, CEO of Mittal Steel Company, a redundantly-titled corporation.

- Cedric Burgher, former CFO of Burger King (he never should have left!).

- Rick Wagoner, CEO of GM

Read More

19.3.06

Quotes Entirely Relevant to Investing Jesse Livermore

-Jesse Livermore

More Investing Quotes

18.3.06

Short Boy-on-Boy

The Boy-on-Boy space is saturated by multiple market actors and opportunities for price discrimination are muddled by a highly fragmented marketplace. Increasing commoditization in the space limits opportunities for upside absent domination by a stronger alpha player. In addition, low or no barriers to entry mean that the stiff foreign competition (Dutch in particular) has deeply penetrated the nearly frictionless space from the bottom up...

Read More

17.3.06

Are Phantom Bonds Right for My Portfolio?

The answer is that it depends.

If you have a 20 year plus horizon, then you probably want an allocation that is heavily weighted towards equity, say 90-100%. But you could supplement a 100% equity allocation with an incremental 20-30% of phantom bonds, without disrupting your asset allocation. How is that possible? Well one of the unique features about phantom bonds is they don't actually exist. So in addition to the existing equity level rate of return, phantom bonds would be adding both non-existant diversification AND non-existant fixed income payments.

Read More

16.3.06

Revising Snoop Dogg Down

Snoop Dogg has rebranded himself repeatedly, going as:

- C. Broadus

- Calvin Broadus

- Snoop

- Bigg Snoop Dogg

- Snoop Doggy Dogg

He lacks focus and recently has gone even further afield. He has appeared in advertisements for Chrysler, promoted hot dogs, and performed cameos in multiple movies. He even went so far as to produce his own porno film.

All this means that Snoop Dogg's returns on incremental capital have been...

Read More

15.3.06

GOOG No Means Yes Baby Part 3

(Read GOOG, No Means Yes Baby Part 1 and GOOG, No Means Yes Baby Part 2 )

Intrigued by the reaction of Mr. Moncrief, in Part 1 and the general inability of these analysts to take "No" for an answer, this analyst arranged for an interview at Mr. Moncrief's midtown offices. We were particularly interested in the impact personalities might have on sell-side professionals. What was the model for their attitude about these stocks that seemed to defy all caution? Ignore all negative news? The transcript is attached below.

Prescott R. Moncrief III (on phone): "...c'mon Bateman. We'll kamikaze over to Nell's, chase some cotton underwear. Charlie Cushing knows this 18-year-old bimbette that's gor-geous. Hold on. WOAH! This skirt who looks just like Ailcia Witt back when she was still hot, like in that Sopranos ep, just walked in, let me call you back, Patrick. Hello. What have we here? I'm Prescott R. Moncrief III, the administrator of this facility. And who might you be?"

Read More

14.3.06

Piratery and Warren Buffett

We have uncovered renewed interest by Berkshire Hathaway in piratery and, in fact, the adoption of piracy directly by Berkshire's Warren Buffett, and therefore we are boosting our recommendation.

Read More

13.3.06

A Guide to Boring Conversations with Financial Professionals

You: So I read in the Journal today, [insert anything].

You: [Any story involving golf or fish or boating where someone does not die or at least get maimed by sonar]

Read More

12.3.06

Quotes Entirely Relevant to Investing Solzhenitsyn

-Aleksander Solzhenitsyn

More Investing Quotes

11.3.06

Sell Out Saturday: Q3'06 Mid-Quarter Earnings Update

After an unstensive SWOT analysis...

Read More

10.3.06

Short Novartis

While we are all for cancer research, it will be really hard to get attractive returns for shareholders on an initial investment of infinity dollars...

Read More