The answer is that it depends.

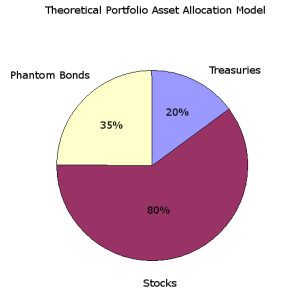

If you have a 20 year plus horizon, then you probably want an allocation that is heavily weighted towards equity, say 90-100%. But you could supplement a 100% equity allocation with an incremental 20-30% of phantom bonds, without disrupting your asset allocation. How is that possible? Well one of the unique features about phantom bonds is they don't actually exist. So in addition to the existing equity level rate of return, phantom bonds would be adding both non-existant diversification AND non-existant fixed income payments.

Read More