CNN is running a story claiming a woman was the greatest pirate of all time. Based on what we know about women and investing, could this be possible?

CNN is running a story claiming a woman was the greatest pirate of all time. Based on what we know about women and investing, could this be possible?The article's claims are incredulistic. They say that Cheng I Sao (allegedly a chick's name fyi) "controlled a fleet of more than 1,500 ships and upwards of 80,000 sailors" and "expanded the scope of the business, branching out from simple attack-and-pillage jobs to protection schemes, blackmail, and extortion [and] set up an extensive spy network and developed economic ties with farmers who would supply her men with food."

Some known facts about women:

- They are bad at investing. Otherwise, I'd know more of them professionally, rather than just "professionally."

- They suck at cutlasses. Have you ever seen a woman successfully dominate someone with a cutlass. It just doesn't happen.

- They cannot hold their rum. Try this out at home with a female you know, forcing them to take down 1 part rum for every 1 part you take down. The results will surprise and please you.

- They do not have peg legs or eye patches. Again, a quick survey of your female "friends" will show this to be the case

Now we checked the article and it did mention several times "she" but the most logical conclusion is that they misunderstood Chinese (we are fluent in both oral Mandarin and written Cantonese) and confused Cheng I Sao's gender accordingly.

Consider this clear evidence that Cheng I Sao was a very savvy and very male investor:

Cheng I Sao's most famous laws applied to the taking of female prisoners. Ugly women were returned to shore, free of charge. Attractive captives were auctioned off to the crew, unless a pirate personally purchased the captive, in which case they were considered married.

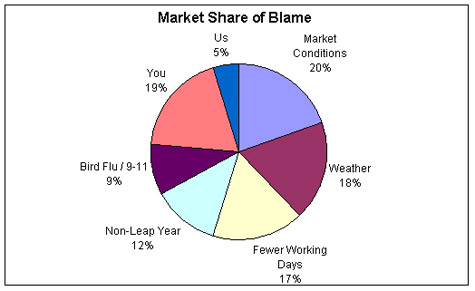

Recommendation: We maintain a "Do not buy" rating on piratery, after calling the top perfectly last year. While fundamentals are improving, there is continued risk that a global economic downturn would impact the richness of pillaging shipping lanes and destroy the return on capital invested in piratery machinery and assets.