30.3.06

A Letter to Our Shareholders: On Being Taken Over

Because we are happy in our cushy offices and enjoy our substantially over-inflated salaries and bonus plans ripe with inexorable options in a fictious stock...

Read More

Piratery on the Catwalk

It was only a few weeks ago, that we outlined that providers of pirate patches and clothing would benefit from the rising piratery tide. Now witness piratery on the catwalk...

It was only a few weeks ago, that we outlined that providers of pirate patches and clothing would benefit from the rising piratery tide. Now witness piratery on the catwalk...Read More

29.3.06

Tales from My Internecine Struggle with the IT Department

The monstrous IT guy remains motionless just ten feet away. Emotions give way to cognitive thought and I train my glare on him. Almost on cue, he begins his approach.

With blinding acceleration, he lurches onto me with a powerful "thud crackle". He slams into my chest. The impact is incredibly powerful, knocking the wind out of me. His huge arms envelope my complete upper body and I can feel my chest plate move as his beak grinds against it...

Read More

28.3.06

Carl Icahn is Blogging?

Read More

27.3.06

The Purchasing Powerless

Read More

26.3.06

Quotes Entirely Relevant to Investing Powerpoint

While you were making your [PowerPoint] slides, we would be killing you.

-Russian officer commenting to a US offier on who would have won if we had ever actually fought WWIII in Western Europe.

More Investing Quotes

24.3.06

Short: Mark Davison

Prosecutors allege that Mr. Davison has been supplementing his income (and failing to report it) via similar Star Trek convention gambits as recently uncovered by Long and Short with respect to Enron bad-guy/Star Trek android David Delainey...

Read More

23.3.06

Ask Julia About Your Length

Julia Mezzanine Tranche is an analyst at Long and Short, as well as a member of the Non-Certified Advice Columnists of America, the International Society of Bad Advice Columnists and Chairwoman of the Prestigious European Association for Paperclip Entrepeneurs and Analysts (PEAPEA).

Note: some letters may be "enhanced" for self-glorification.

Dear Julia:

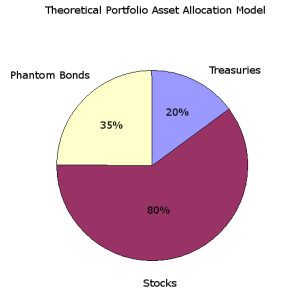

Recently, Long or Short Capital's Johnny Debacle wrote an [interesting and dynamic piece on Phantom Bonds totally characteristic of the brilliant analysis that typifies Long or Short Capital]. He indicates:

If you have a 20 year plus horizon, then you probably want an allocation that is heavily weighted towards equity, say 90-100%. But you could supplement a 100% equity allocation with an incremental 20-30% of phantom bonds, without disrupting your asset allocation.

As I am 102 years old, my own horizon is somewhat shorter. Can you recommend some Phantom Bond allocations that might be better for my needs?

Signed,

I'm Dreadfully Hearing Impaired in Tiny Ithica, Texas.

Read More

22.3.06

JD's Lending No-No's #2 and #3

- Lending No-No #2a: Don't loan to companies who will need to control costs, if they have no connection to actual real world cost controlling.

Examples: - I was recently in an Italian city for a meeting. The company I was there to see indicated that the best way from the Aeroporto to the meeting was by taxi, so I trusted them and took a taxi. It was €80. I later found out that there was a €5 shuttle express that would have taken me with half a km of the meeting and would have taken about 10 minutes more. These are the people charged with cutting costs in a large industrial company that operates in a cyclical sector that saw several competitors file for bankruptcy only a few years ago.

Read More

21.3.06

How Not to Name Your Company

Read More

20.3.06

Appropriately Named Executives

- Lakshmi Mittal, CEO of Mittal Steel Company, a redundantly-titled corporation.

- Cedric Burgher, former CFO of Burger King (he never should have left!).

- Rick Wagoner, CEO of GM

Read More

19.3.06

Quotes Entirely Relevant to Investing Jesse Livermore

-Jesse Livermore

More Investing Quotes

18.3.06

Short Boy-on-Boy

The Boy-on-Boy space is saturated by multiple market actors and opportunities for price discrimination are muddled by a highly fragmented marketplace. Increasing commoditization in the space limits opportunities for upside absent domination by a stronger alpha player. In addition, low or no barriers to entry mean that the stiff foreign competition (Dutch in particular) has deeply penetrated the nearly frictionless space from the bottom up...

Read More

17.3.06

Are Phantom Bonds Right for My Portfolio?

The answer is that it depends.

If you have a 20 year plus horizon, then you probably want an allocation that is heavily weighted towards equity, say 90-100%. But you could supplement a 100% equity allocation with an incremental 20-30% of phantom bonds, without disrupting your asset allocation. How is that possible? Well one of the unique features about phantom bonds is they don't actually exist. So in addition to the existing equity level rate of return, phantom bonds would be adding both non-existant diversification AND non-existant fixed income payments.

Read More

16.3.06

Revising Snoop Dogg Down

Snoop Dogg has rebranded himself repeatedly, going as:

- C. Broadus

- Calvin Broadus

- Snoop

- Bigg Snoop Dogg

- Snoop Doggy Dogg

He lacks focus and recently has gone even further afield. He has appeared in advertisements for Chrysler, promoted hot dogs, and performed cameos in multiple movies. He even went so far as to produce his own porno film.

All this means that Snoop Dogg's returns on incremental capital have been...

Read More

15.3.06

GOOG No Means Yes Baby Part 3

(Read GOOG, No Means Yes Baby Part 1 and GOOG, No Means Yes Baby Part 2 )

Intrigued by the reaction of Mr. Moncrief, in Part 1 and the general inability of these analysts to take "No" for an answer, this analyst arranged for an interview at Mr. Moncrief's midtown offices. We were particularly interested in the impact personalities might have on sell-side professionals. What was the model for their attitude about these stocks that seemed to defy all caution? Ignore all negative news? The transcript is attached below.

Prescott R. Moncrief III (on phone): "...c'mon Bateman. We'll kamikaze over to Nell's, chase some cotton underwear. Charlie Cushing knows this 18-year-old bimbette that's gor-geous. Hold on. WOAH! This skirt who looks just like Ailcia Witt back when she was still hot, like in that Sopranos ep, just walked in, let me call you back, Patrick. Hello. What have we here? I'm Prescott R. Moncrief III, the administrator of this facility. And who might you be?"

Read More

14.3.06

Piratery and Warren Buffett

We have uncovered renewed interest by Berkshire Hathaway in piratery and, in fact, the adoption of piracy directly by Berkshire's Warren Buffett, and therefore we are boosting our recommendation.

Read More

13.3.06

A Guide to Boring Conversations with Financial Professionals

You: So I read in the Journal today, [insert anything].

You: [Any story involving golf or fish or boating where someone does not die or at least get maimed by sonar]

Read More

12.3.06

Quotes Entirely Relevant to Investing Solzhenitsyn

-Aleksander Solzhenitsyn

More Investing Quotes

11.3.06

Sell Out Saturday: Q3'06 Mid-Quarter Earnings Update

After an unstensive SWOT analysis...

Read More

10.3.06

Short Novartis

While we are all for cancer research, it will be really hard to get attractive returns for shareholders on an initial investment of infinity dollars...

Read More

I bet you've at least seen the MOVI

Read More

9.3.06

GOOG No Means Yes Baby Part 2

Quiz: Place the two statements in chronological order.

Statement 1: Google (Related Reports) Letter to shareholders-

We will make decisions on the business fundamentals, not accounting considerations, and always with the long term welfare of our company and shareholders in mind. Although we may discuss long term trends in our business, we do not plan to give earnings guidance in the traditional sense. We are not able to predict our business within a narrow range for each quarter. We recognize that our duty is to advance our shareholders' interests, and we believe that artificially creating short term target numbers serves our shareholders poorly. We would prefer not to be asked to make such predictions, and if asked we will respectfully decline. A management team distracted by a series of short term targets is as pointless as a dieter stepping on a scale every half hour.

Read More

8.3.06

Mr Juggles Investing Commandments (#3 & #4)

- Rule #3: Stocks with attractive IR women are no more likely to appreciate than average, but they are more fun to cover.

- Stocks are, in the end, a good that is subject to the normal laws of supply and demand. A CEO who hires an attractive IR woman understands marketing and is stimulating demand; after all, his target demographic -- financial analysts at large investment firms -- is almost exclusively male and geeky. Unfortunately, these same CEOs have a propensity to overspend and have questionable judgement (tending to, say, sleep with members of the IR department). Thus, on balance, these stocks are not any more likely to perform better than stocks with unattractive IR women or men but, if you are in the aforementioned demographic, you are more likely to enjoy your time with the company. That's a net win for you. Half of investing is picking the right asset class.

Read More

GOOG No Means Yes Baby Part 1

Reyes initially commented that, Google is "getting to a point where the law of large numbers starts to take root..." He continued to say that "At the end of the day, growth will slow..." and that "We're going to have to find other ways to monetize the business."

The sell side responded with comments including...

Read More

7.3.06

Chinese Military TV Announcers

Read More

Improving Our Diversity Metrics

Read More

6.3.06

Shorting David Delainey

Read More

5.3.06

Quotes Entirely Relevant to Investing CPA Accounting

"Accountancy was my life until I discovered Smirnoff."

-Vodka advertisement from 70's

More Quotes

4.3.06

Sellout Saturday: For Charity

Read More

1.3.06

Overheard in Our (Fictious) Office

"Overall, this strategy has led to a runrate of Google hits which has doubled for [LongorShortCapital.com] vs [LongorShort.blogspot.com]. We have lost the SE query flows from "Short Mexican Joke" and "Sexy Chinese," but I think we'll survive, especially because "Scone"...

Read More