26.12.05

New Product Idea: Titanium-cut Oatmeal

Most fancy restaurants and hotels offer steel-cut oatmeal. But, last time I checked, steel is not that hard a substance. On the absolute hardness scale, it rates an 80 or 90 as compared to 1600 for a diamond. Until I can feel diamond dust in my bowels, there's good money to be made in oatmeal.

16.12.05

Exotic Plush Pillowmakers Upgraded to Maybe Buy

Continuing with our earlier analysis of a potential pillow pair trade, our staff has recently upgraded our position on exotic plush pillow makers from "Do Not Buy" to "Maybe Buy." Reasons for the upgrade include strong YOY growth in plush pillow sales volume, especially in the very competitive food facsimile space, despite tough comps as well as the broadening demand as people recognize the excellence of novelty plush. It doesn't hurt that Kaiser sleeps on this every night.

Hamburger Pillow:

Recommendation: We maintain our "Long" rating for pillow makers with emerging market focus, and our "Short" rating for domestic pillow makers, while upgrading Exotic Plush Pillows to a "Maybe Buy."

Hamburger Pillow:

This is the biggest Cheeseburger ever! With this big Cheeseburger pillow, whether you are watching TV or taking a rest, it will provide you with the best comfort! It is very soft and cuddle! There are cheese, lettuce, and beef inside.

Recommendation: We maintain our "Long" rating for pillow makers with emerging market focus, and our "Short" rating for domestic pillow makers, while upgrading Exotic Plush Pillows to a "Maybe Buy."

13.12.05

Incredibly True Quick Serve Restaurant Truths

The CFO of Burger King is named Cedric Burgher. Link BK CFO. This incredibly true turth is even more incredible when you come to grips with the fact that the suffix for Burger King employee emails is @whopper.com.

The founder and CEO of McDonald's is not the Hamburgler as some people mistakenly presume. Although, it is true that he did attempt to "hamburgle" McD's in a failed early 1980's LBO.

The founder and CEO of McDonald's is not the Hamburgler as some people mistakenly presume. Although, it is true that he did attempt to "hamburgle" McD's in a failed early 1980's LBO.

6.12.05

JD's Favorite Soup Recipe

1) Order cheese pizza from your finest local supplier.

2) Put it in a bowl.

3) Eat with spoons.

Serves 2.

2) Put it in a bowl.

3) Eat with spoons.

Serves 2.

5.12.05

Monopoly Board Game: Playing with Real Money and a Developed Capital Market

How does one play Monopoly with real money and a functioning capital market with an an interest rate based on the "Trip Around the Board" unit of time all the while maintaining the quirky board specific events?

This is our project.

Long or Short Capital has established these preliminary rules following our initial dilligience.

Long or Short Capital will continue to revise the game by thinking "Big Thoughts" and by listening to input from both readers and the illiterate, until a proper Capital Market Monopoly Board Game (CMMBG) has been resolved. Then we we will host a game. Possibly online and to a flurry of lawsuits.

This is our project.

Long or Short Capital has established these preliminary rules following our initial dilligience.

- The game should use some set a ratio as an exchange rate of dollars to monopoly dollars as an initial buy-in. Players should not be able to exchange money in or out of the game until the game is finished.

- Players would have to start with very little money forcing them to have to raise capital for anything but the most marginal investments.

- All asset transactions as well as mergers are permitted, with the stipulation that terms under which all transactions occur are upheld and honored.

- There should be at least 6 players, 2 of which will be bankers (see below).

- The game would definitely need one permanent banker, perhas two to prevent monopolistic banking practices. The bankers would have to be judged by the same scale as the players --profits generated through savvy banking. The wrinkle is that you would probably have to judge one banker's profit making against the others.

- Game Duration: Time delimited or turn delimited or until one player has a made amount of money or until only one non-banker player is left standing?

Long or Short Capital will continue to revise the game by thinking "Big Thoughts" and by listening to input from both readers and the illiterate, until a proper Capital Market Monopoly Board Game (CMMBG) has been resolved. Then we we will host a game. Possibly online and to a flurry of lawsuits.

4.12.05

Are Diamonds Marketed at the Idiot Demographic?

Say Forever I Do with an uncut bag o' diamonds "mixed with the natural elements they are found." Perhaps the missing link from diamonds to the Idiot Demographic.

2.12.05

Счастливого отпуска!! or Is Russia A Place to Invest or a Place to Fear?

This will be a point/counterpoint analysis. Kaiser, unbeknownst to him until now and fresh off a trip to Germany, will supply the counterpoint.

A common investing theme is that Russia is the place to put your money. Why?

Burgeoning middle class!!

Favorable demographics!!

Heavily educated human capital base from which to draw!!

More oil than T. Boone Pickens!!

Business friendly, and otherwise unfriendly, Dictator Tsar General-Secretary President Putin!!

Tradition of outlining and executing 3-5 year plans!!

Tradition of strongly protected property rights, economic openness and political stability!!

Literature with greats like Aleksandr Solzhenitsyn!!

And for the kids...GULAGS!!

Well sorry to be the turd in the blinchiki but Russia is jockeying to try and do the only thing they know to try and do: nuke the USA and rule the world. They don't care about economic openness. They don't care about working hard and they don't believe in capitalism. They want three things, in no specific order.

Vodka.

World Domination.

To do evil.

It is an entire nation which channels the ethos of lazy ammoral kleptocracy. When I was there 11 years ago, my main takeaway is that if there is one redeeming quality about Russia it is the null set. When I have studied Russia, it has seemed like a good place to be unhappy, or to be purged, or to be evil, or to die from nuclear fallout, or to have your loans defaulted on and your money swindled.

And Russia is not a place to invest money for these very same reasons. They don't have ethics. They refuse to live without corruption which would make a Chinese Judge blush. They are both willing and able to expropriate any foreign direct investment. And don't think they aren't still cooking up ways to drop Cuban paratroopes into small unsuspecting Coloradan towns.

Russia is a place to FEAR. Avoid buying stocks, bonds, derivatives and any other security or financial interest which are dependent upon Russian assets....Unless you look forward to waking up a year or two for now and opening your personal portfolio account and wondering "Hey where did my Gazprom go!" as you look at a 'Thank you Comrade' note signed "Sincerely, V Putin."

Recommendation: Ask your financial advisor about low cost index funds which track the Moscow Stock exchange. Then, "do not buy" them.

A common investing theme is that Russia is the place to put your money. Why?

Burgeoning middle class!!

Favorable demographics!!

Heavily educated human capital base from which to draw!!

More oil than T. Boone Pickens!!

Business friendly, and otherwise unfriendly, Dictator Tsar General-Secretary President Putin!!

Tradition of outlining and executing 3-5 year plans!!

Tradition of strongly protected property rights, economic openness and political stability!!

Literature with greats like Aleksandr Solzhenitsyn!!

And for the kids...GULAGS!!

Well sorry to be the turd in the blinchiki but Russia is jockeying to try and do the only thing they know to try and do: nuke the USA and rule the world. They don't care about economic openness. They don't care about working hard and they don't believe in capitalism. They want three things, in no specific order.

Vodka.

World Domination.

To do evil.

It is an entire nation which channels the ethos of lazy ammoral kleptocracy. When I was there 11 years ago, my main takeaway is that if there is one redeeming quality about Russia it is the null set. When I have studied Russia, it has seemed like a good place to be unhappy, or to be purged, or to be evil, or to die from nuclear fallout, or to have your loans defaulted on and your money swindled.

And Russia is not a place to invest money for these very same reasons. They don't have ethics. They refuse to live without corruption which would make a Chinese Judge blush. They are both willing and able to expropriate any foreign direct investment. And don't think they aren't still cooking up ways to drop Cuban paratroopes into small unsuspecting Coloradan towns.

Russia is a place to FEAR. Avoid buying stocks, bonds, derivatives and any other security or financial interest which are dependent upon Russian assets....Unless you look forward to waking up a year or two for now and opening your personal portfolio account and wondering "Hey where did my Gazprom go!" as you look at a 'Thank you Comrade' note signed "Sincerely, V Putin."

Recommendation: Ask your financial advisor about low cost index funds which track the Moscow Stock exchange. Then, "do not buy" them.

1.12.05

Piratery fka Piracy: Primer to Investing in Cutlasses, Rum and Pillaging

Pirates.

Piracy used to be an important industry providing raping and pillaging services for emerging market economies and sovereign states. Fine countries such as Trinidad and Tobago were built on the pirate economy. Can you imagine England if pirates hadn't been around? It would now be the United Kingdom of Mexico and London would be New Seville, had it not been for an enterprising fleet of bucaneers.

Pirate Opportunities

Over the past couple decades, shipping companies, luxury cruiselines and international boating have all seen large increases in net profits. However, there has not been a commensurate rise in piratery.

Piratery provides a compelling ROI for the entrepeneurial seaman. For an investment of $20-30k in a boat, some deckhands and rental cutlasses, a pirate captain can realize a 50-60% ROI in one year. Given the proper locale, of course. For example, the coast of Somalia is a competitive, if fragmented, market. See Somali Pirates Out of Control or Somali Pirates Free Ship After Month of Captivity or Pirates Attack Cruisership or the free daily paper's headline from yesterday simply titled "ARGH!" for more details.

But setting up a lair in a place like Isla Margarita, located off the northern coast of Venenzuela, would be an environment with relatively low piratery penetration but proximity to major cruiseline and OPEC oil routes. An added bonus, Isla Margarita is where non-pirate berserker Lope de Aguirre reached his crescendo.

You need to strike while the iron is hot and not be heedin any naysayers or scallywags. Piratery is your path to financial freedom. You'll be flying the skull & crossbones over a Jupiter, FL mansion in no time.

Recommendation: Depending on your investing horizon, commence pirate raids on commercial trading routes immediately or ask your financial advisor about low cost index funds which track the piratery index. Swig a few shots of Mount Gay, if need be.

30.11.05

Pillow Pair Trade

Long or Short Capital has completed extensive fundmental analysis of the pillow market. After surveys, studies, and focus groups a few conclusions have become obvious:

Pillows are most often used by consumers for sleep-assistance purposes although they can sometimes be used for back support and/or playful fights in sorority houses

The optimal Full Pillow Equivalent (FPE) to Human Head ratio is approximately 1.0x

Pillow pricing is directly proportional to the average number of frills per pillow as well as the number of fabric colors per pillow. Pricing is generally inversely correlated to the utility and comfort of a pillow.Some of these conclusions are surprising given the current state of the pillow market. For instance, in the US, FPEs per Human Head are running at almost 3.4x vs. the 1.0x optimal level. Note that this estimate includes almost 6 decorative pillows per household (or 1.2 FPEs). Meanwhile, FPEs per Human Head are approximately 0.1x in developing economies such as Malaysia and Zimbabwe and around 0.6x in China, the world's most populous country.

We feel strongly that these trends will converge in the long term with the US (and Europe, to a lesser extent) reducing their consumption of frilly, non-functional pillows and developing countries upgrading from rocks to pillows for head support. Our surveys of starving third world citizens find that pillows run fifth on desired items following only clean water, freedom, blond hair and Pampers for the kids. This presents an attractive investment opportunity.

Recommendation:

We are recommending a pair trade: Go long pillow makers with emerging market focus and short domestic pillow makers.

We feel strongly that these trends will converge in the long term with the US (and Europe, to a lesser extent) reducing their consumption of frilly, non-functional pillows and developing countries upgrading from rocks to pillows for head support. Our surveys of starving third world citizens find that pillows run fifth on desired items following only clean water, freedom, blond hair and Pampers for the kids. This presents an attractive investment opportunity.

Recommendation:

We are recommending a pair trade: Go long pillow makers with emerging market focus and short domestic pillow makers.

29.11.05

I Can't Agree More... Unless I Change These Words

People who decry the fact that businesses are in business "just to make money" seldom understand the implications of what they are saying. You make money by doing what other people want, not what you want.This is Thomas Sowell's succinct and accurate rebuttal to all those who decry the manifold splendor of capitalism and stuff. Amazing.

But this statement is equally true about monkeys throwing feces. Especially when I change the words.

People who decry the fact that monkeys who throw feces are throwing feces "just to throw feces" seldom understand the implications of what they are saying. Monkeys who throw feces throw feces by doing what other monkeys want, not what they want.

19.11.05

Sellout Saturday Dos

This post could have been titled "We tried to sell-out but Google wouldn't let us." Why wouldn't they let us? Because Google's Firefox referral is a complete abject failure -- we didn't get paid for any of our referred downloads. Live and learn. Bye Google referral, we'd rather invest our money in lime futures than waste sidebar space with your link.

This week we have better sell out. Adverts in our RSS feed. Yahoo finally has them and we're going to stick them in, and report the results one week from today. And you're going to love them because who doesn't love ads???

This week we have better sell out. Adverts in our RSS feed. Yahoo finally has them and we're going to stick them in, and report the results one week from today. And you're going to love them because who doesn't love ads???

17.11.05

Architecture and Tourists

I've often heard that you can spot tourists in NYC or San Fran because they are the ones staring up at the buildings. But I realized today that if you follow that advice, you always end up mistaking architecture students for tourists.

14.11.05

LongorShort Increases Quarterly Dividend to $1.50 Per Subscriber

Quarter-to-date performance has been excellent and revenue is growing in the low triple digits. The subscriber base has been growing at a modest rate, so Longorshort has exhibited significant dividend growth leverage. In conjunction with this dividend increase, management is also increasing the dividend share of revenue from 80% to 85%. Via my model, the implied current market capitalization of Longorshort is $12,545 and each subscriberstake is worth $193. To be fair, my model wasn't designed to analyze this kind of investment, but it is otherwise incredible in its brilliance and accuracy.

12.11.05

Sellout Saturday

Cash flow. We all know what it is. Everybody wants some. In light of our new Longorshort dividend policy, we need it. But how do we get it?

Simple. Sell out as much as possible. Each Saturday we will try and take it down a notch and whore ourselves in new and shameless ways. As part of the deal, the following Saturday we'll let you know how successful our greed was.

This week's sellout: Download the limited edition Firefox through the button on the top left of the sidebar. This only applies to people who don't have Firefox installed already.

You can put cash money in our pockets and make us rich beyond your wildest dreams. Don't know what the Firefox browser is and why it is good to use? Well we don't know either, but rumor has it that it turns html into gold and sends it directly into your bank account. Either that or it makes you 4 inches taller and 3x as smart.

Each time you download Firefox and install it, use it, and love it, Google issues us a single share in their company. Or gives us a dollar. We're unsure about that part.

Download it now before Google runs out of Firefoxes and has to make more.

Simple. Sell out as much as possible. Each Saturday we will try and take it down a notch and whore ourselves in new and shameless ways. As part of the deal, the following Saturday we'll let you know how successful our greed was.

This week's sellout: Download the limited edition Firefox through the button on the top left of the sidebar. This only applies to people who don't have Firefox installed already.

You can put cash money in our pockets and make us rich beyond your wildest dreams. Don't know what the Firefox browser is and why it is good to use? Well we don't know either, but rumor has it that it turns html into gold and sends it directly into your bank account. Either that or it makes you 4 inches taller and 3x as smart.

Each time you download Firefox and install it, use it, and love it, Google issues us a single share in their company. Or gives us a dollar. We're unsure about that part.

Download it now before Google runs out of Firefoxes and has to make more.

11.11.05

The Game Over Paradigm for News Reporting

This Marketwatch headline just caught my attention.

Game over for Chinese Internet game operators?

I have no opinion as to the veracity of that statement, but it got me thinking: why do these silly little journalists even bother hiding the fact that they don't actually do any sort of journalistic research? Instead they just take the subject matter for an article, figure out a pun title and and have a team of monkeys* fill the rest.

Do newspaper firms even do old-school style journalism anymore? Why not shift the paradigm overtly and stop paying lip service to research? Just report the world based on low hanging puns. Think of the brave new world we could create! Everything reported would be thin slice reactions based not on events but the visceral vocabularic responses which they inspire.

You wake up, put on your mumu and go straight to marketwatch.com to see the latest news:

RIMM results are Berry Good

Revlon Attempts to put a Good Face on Results

Caterpillar Demolishes Estimates

P&G Numbers Need a Swiffer Picker-Upper

SC Johnson Results Go Down the Drano

Analysts Examine ConAgra 3Q05 Net Income and Wonder: Where's the Beef?

Ipod Competition Seeks to Take a Bite Out of Apple

Investors are Stone Cold as WWE Wrestles With Declining Ratings

Rob Glaser Rhapsodizes on Real's Future

Lack of Toy Sales Spell 'Dr Doom' for Marvel

When I buy a newspaper company, or, more likely am handed one for free as I walk up from the subway, it's going to be amazing. Investors will thank me, ladies will love me. Truth is much harder to produce and less marketable than superficial entertainment.

Recommendation: A savvy private equity firm should pick-up some newspapers on the cheap and apply the Game Over Paradigm; it would be Game Over for the competition.

Mr Juggles advised on this article

Game over for Chinese Internet game operators?

I have no opinion as to the veracity of that statement, but it got me thinking: why do these silly little journalists even bother hiding the fact that they don't actually do any sort of journalistic research? Instead they just take the subject matter for an article, figure out a pun title and and have a team of monkeys* fill the rest.

Do newspaper firms even do old-school style journalism anymore? Why not shift the paradigm overtly and stop paying lip service to research? Just report the world based on low hanging puns. Think of the brave new world we could create! Everything reported would be thin slice reactions based not on events but the visceral vocabularic responses which they inspire.

You wake up, put on your mumu and go straight to marketwatch.com to see the latest news:

RIMM results are Berry Good

Revlon Attempts to put a Good Face on Results

Caterpillar Demolishes Estimates

P&G Numbers Need a Swiffer Picker-Upper

SC Johnson Results Go Down the Drano

Analysts Examine ConAgra 3Q05 Net Income and Wonder: Where's the Beef?

Ipod Competition Seeks to Take a Bite Out of Apple

Investors are Stone Cold as WWE Wrestles With Declining Ratings

Rob Glaser Rhapsodizes on Real's Future

Lack of Toy Sales Spell 'Dr Doom' for Marvel

When I buy a newspaper company, or, more likely am handed one for free as I walk up from the subway, it's going to be amazing. Investors will thank me, ladies will love me. Truth is much harder to produce and less marketable than superficial entertainment.

Recommendation: A savvy private equity firm should pick-up some newspapers on the cheap and apply the Game Over Paradigm; it would be Game Over for the competition.

Mr Juggles advised on this article

* People know monkeys for their proclivity for eating bananas and flinging their feces, but few know of the unparallelled productivity which a properly incented monkey is capable of. A few bananas go a long way

8.11.05

Outsourcing My Thoughts On Outsourcing: Part 1

I believe strongly in applying six sigma to everything, from ironing my dress shirts to creating this website. But, there is a limit to how much efficiency improvement I can squeeze out of my creative stone and past that limit I have to look to source my content from other channels, even overseas. Thus, my official position on outsourcing is brought to you by Jack from EZGone in New Delhi whom I hired through elance.com. He has has prepared a series of short speeches on outsourcing, which he has injected with humor, rhetoric and truth, according to my exacting specifications. What follows is Part 1. Read it aloud with a Brtish accent for maximum effect.

Outsourcing Outsourcing: What Is Outsourcing And Why It Is Growing?

Friends, I hope that I am not sounding vague to some of you. I know, I know most of my learned audience knows about outsourcing, but let me give it a try.

In purely religious terms, it could be seen as one of believers and non-believers. And both sides, there is no doubt in my mind, have very strong, logical arguments as why they are believer and non-believer.

Friends, at the outset, let me make clear to you that I belong to the camp of believers and I would like to focus on a crucial strand of this outsourcing business --- why it is great for firms who believe in outsourcing and actually do it.

The making of things was outsourced decades ago to foreign nations such as India, China, Japan, Philippines etc. Today, we Americans are hardly aware that most of the things that we see today around us, like our TVs, computers, cell phones, underwear, dentures, cartoons, financial analysis, investment advice etc., must come from somewhere, but we have no real clue who is making them, or how. We are really busy in hiking, trekking, vacationing or any other activities of our choice that we hardly get time to consider these things seriously, and perhaps, we have enough trouble figuring out how to remove the packaging.

Experts believe that even humor is being outsourced.

Perhaps, the modern day hip-hop youngsters won't believe this, but there was a time when Americans actually made physical things called "products" right here in America. Once upon a time, right here, workers would go to large grimy and encrusted buildings called "factories," where they would take a raw material such as iron ore and perform industrial acts on it, such as "forging" and "smelting" to make their own things. And, as you can easily imagine, by the end of the day, they smelt terrible (not perfumed) but they were satisfied that they had turned the ore into something useful, for example a bicycle.

But now, we don't make anything. Rather, we have learned, intelligently, how to get the things done at much lower cost and much faster speed. Credit, of course goes to outsourcing.

Outsourcing Outsourcing: What Is Outsourcing And Why It Is Growing?

Friends, I hope that I am not sounding vague to some of you. I know, I know most of my learned audience knows about outsourcing, but let me give it a try.

In purely religious terms, it could be seen as one of believers and non-believers. And both sides, there is no doubt in my mind, have very strong, logical arguments as why they are believer and non-believer.

Friends, at the outset, let me make clear to you that I belong to the camp of believers and I would like to focus on a crucial strand of this outsourcing business --- why it is great for firms who believe in outsourcing and actually do it.

The making of things was outsourced decades ago to foreign nations such as India, China, Japan, Philippines etc. Today, we Americans are hardly aware that most of the things that we see today around us, like our TVs, computers, cell phones, underwear, dentures, cartoons, financial analysis, investment advice etc., must come from somewhere, but we have no real clue who is making them, or how. We are really busy in hiking, trekking, vacationing or any other activities of our choice that we hardly get time to consider these things seriously, and perhaps, we have enough trouble figuring out how to remove the packaging.

Experts believe that even humor is being outsourced.

Perhaps, the modern day hip-hop youngsters won't believe this, but there was a time when Americans actually made physical things called "products" right here in America. Once upon a time, right here, workers would go to large grimy and encrusted buildings called "factories," where they would take a raw material such as iron ore and perform industrial acts on it, such as "forging" and "smelting" to make their own things. And, as you can easily imagine, by the end of the day, they smelt terrible (not perfumed) but they were satisfied that they had turned the ore into something useful, for example a bicycle.

But now, we don't make anything. Rather, we have learned, intelligently, how to get the things done at much lower cost and much faster speed. Credit, of course goes to outsourcing.

7.11.05

LongorShort Announces 1st Quarterly Dividend of $1.00

Pending the routine audit of our 1st quarter results, LongorShort plans to begin paying a quarterly dividend, using the cash generated by our hilarious operations to create value for our subscriberholders. The board considered a number of strategeric options including: a hostile takeover of Marginal Revolution, paying bums to advertise for us, and blowing all the cash on hookers and coke. Instead, we have decided to initiate a quarterly dividend of $1.

Our reasoning was simple: We realized that we value you, our readers, and now you will finally be able to value us. Literally. Assuming a $1 quarterly dividend, no growth, and an 8% discount rate, being a subscriberholder is worth $50.

Risks and Uncertainties

Our reasoning was simple: We realized that we value you, our readers, and now you will finally be able to value us. Literally. Assuming a $1 quarterly dividend, no growth, and an 8% discount rate, being a subscriberholder is worth $50.

- Who are your subscriberholders:

- Email and XML subscribers as of 10/28/05. These are the only readers we can reliably verify and who will be eligible for this quarter's dividend. Additionally, we feel that they are also the stickiest readers and we are big proponents of RSS usage. They have the largest stake in us.

- How does a subscriber collect a dividend:

- For Email Subscribers: Send an email to misterjuggles@gmail.com from your subscription email with your paypal address and we will send you $1. Cash money.

- For XML subscribers: Send an email to misterjuggles@gmail.com with the "Subsciption Verification Code" enclosed (you should have received a "magical word" on Sunday in our feed). Enclose your paypal address and we will send you $1. Cash money.

- All unused money will be reinvested back into the website.

- What about your next quarterly dividend:

- Our next quarterly dividend will be determined by the following formula. The lesser of $1 per subscriberholder or (80% of revenue) divided by the number of subscriberholders at quarter end. The latter formula would have yielded a $1.50 dividend, so the $1 dividend has quite a bit of cushion. After this quarter, we will require people to fulfill some sort of registration, as of yet undetermined, to be eligible. It shall be light.

- We will also revise up the dividend if our revenue per a subscriber improves; we will never revise down or suspend the dividend without a proxy vote of registered subscriberholders.

- Why are you doing this:

- We will be the first and only site to issue a dividend.

- This dividend cements our place among the elite internet companies. Please note that our quarterly dividend will be larger than that of Yahoo, eBay, and Google combined.

- It combines finance with the absurd.

- It turns our subscribers into stakeholders and incents them to grow our revenues, by bringing in traffic or driving themselves to our sponsors. We believe proper incentives can solve any problem, from internet site readership to global poverty. Hence our support of the Grameen Foundation.

- We obviously are not in this for the money so this is a much more appopriate use of the ad revenue.

- Numerated lists are pretty sweet.

- How do I become a subscriberholder:

- Use the buttons and forms at the top left to subscribe via email or XML. We recommend the latter, since Feedburner helped us with this process and we are totally long them.

Risks and Uncertainties

Neither the SEC nor any state securities commission has approved or disapproved of the subscriberholdership securities or determined if this prospectus is truthful or complete. As a subscriberholder, you are being granted Class B shares in LongorShort. You should probably realize that Class A shares (there is actually only one Class A share and it's held by Mr Juggles) have perfty-perf votes per share compared to 1.25 votes per share for Class B.

29.10.05

The Corporate Tarpit: MOVI

27.10.05

Why Miers could never be part of the new SCOTUS.

Investment analysis trumps political analysis yet again. Conservative originalist lackeyish with a hint of espirit de redeconstructionalism? Like that matters when the woman can't dance.

Readers who read our reseach report on John Roberts and his familial ability to break-it-down knew that Miers' nomination was doomed because the woman clearly can't shake it herself and lacks any rug-cutting progeny. FYI to Harriet: the new court will hopping and if you aren't getting down, you ain't getting in.

Recommendation: Potential SCOTUS nominees should consider buying a dance pad and practicing in the confines of their own home.

Readers who read our reseach report on John Roberts and his familial ability to break-it-down knew that Miers' nomination was doomed because the woman clearly can't shake it herself and lacks any rug-cutting progeny. FYI to Harriet: the new court will hopping and if you aren't getting down, you ain't getting in.

Recommendation: Potential SCOTUS nominees should consider buying a dance pad and practicing in the confines of their own home.

25.10.05

Investing in Public Equities is Like Dating

I would like everyone to know that I am writing a future best-selling series of business books. It will be a syndicated series, kind of like Chicken Soup for the Soul. You know, first it was Chicken Soup for the Soul, then it was Chicken Soup for the Teenage Soul, then Chicken Soup for the Deaf Prostitute's Soul, then the ground-breaking, recursive Chicken Soup for the Chicken's Soul. My series will be similar and follow the formula Investing in Public Equities is like [Blank].

The first edition will be Investing in Public Equities is Like Dating. Here's the idea: During one of the many rocky periods in a particular personal relationship, I remember asking my parents (married for 25 years) whether or not they had ever gone through tough times when they were starting out. Their basic answer: Relationships, despite what your girlfriend just told you, aren't supposed to be "work." "Work" is supposed to be "work," hence the name. When a relationship is right there won't be a lot of analyzing, discussing, and dissecting every aspect of the relationship as if it's a third, independent entity.

Now the reason I think relationships are a particularly good analogy for investing is that it's just as tough to know when you should cut your losses in a stock as it is when things go south with your girlfriend. You’ve been through a lot and there’s a shared history; is there something fundamentally wrong or are you just being impatient/unreasonable/(insert common male or investor characteristic here)? Finding an investment thesis is at least as hard as going back to dating, and you never want to bail on a good idea early. So ask yourself: the stock isn’t working but is this a healthy argument with your future wife or maybe you and the stock are fighting again because things just aren't right between the two of you. Does the stock want you to "work on it" or "pay attention to its needs" more often? These are probably signs you should set cut that stock loose.

But don't think it'll be easy. The day you finally give up on that stock - it'll go up 5%, just like your ex-girlfriend will wear a short skirt and slut herself around showing you how many other boys like her. But your better off man, you are way better off.

Recommendation: Long book writing, short dating.

The first edition will be Investing in Public Equities is Like Dating. Here's the idea: During one of the many rocky periods in a particular personal relationship, I remember asking my parents (married for 25 years) whether or not they had ever gone through tough times when they were starting out. Their basic answer: Relationships, despite what your girlfriend just told you, aren't supposed to be "work." "Work" is supposed to be "work," hence the name. When a relationship is right there won't be a lot of analyzing, discussing, and dissecting every aspect of the relationship as if it's a third, independent entity.

- In fact, finding a promising investment thesis is similar to meeting a new girl who might be dating material. Examine the similarities:

Dating: - Is she truly interesting? Can she take a joke? Does she come from a decent family (i.e., just how crazy will she be later in life)? Is she good looking all the time or only in dark bars? What do your friends think of her?

- Investing:

- Does the management team know what they’re doing? Does the company have sustainable barriers to entry in their key businesses? Is the company well positioned for the next 3-5 years? What do the company’s customers and suppliers say?

- Sometimes -- ok, a lot of times in Mr. Juggle's case -- things just won't feel right even when the answers to most of these questions are positive. Just as a relationship can lack chemistry, a stock can look promising in theory but fail to perform. You will find yourself constantly justifying the stock to your friends, talking about how great the company is and how the chart is smiling at you. And much like your first relationship that you dragged on far too long, you'll be tempted to "work through it" and stick around. Again, examine the similarities:

Dating: - I'll put more effort in our relationship... Ok, I'll try to change... I'm sorry...

- Investing:

- There was no operating leverage but we'll see it next quarter for sure... They've assured me they have the financing in place.... The investment period is almost over...Management has a lot of "skin in the game"....

Now the reason I think relationships are a particularly good analogy for investing is that it's just as tough to know when you should cut your losses in a stock as it is when things go south with your girlfriend. You’ve been through a lot and there’s a shared history; is there something fundamentally wrong or are you just being impatient/unreasonable/(insert common male or investor characteristic here)? Finding an investment thesis is at least as hard as going back to dating, and you never want to bail on a good idea early. So ask yourself: the stock isn’t working but is this a healthy argument with your future wife or maybe you and the stock are fighting again because things just aren't right between the two of you. Does the stock want you to "work on it" or "pay attention to its needs" more often? These are probably signs you should set cut that stock loose.

But don't think it'll be easy. The day you finally give up on that stock - it'll go up 5%, just like your ex-girlfriend will wear a short skirt and slut herself around showing you how many other boys like her. But your better off man, you are way better off.

Recommendation: Long book writing, short dating.

22.10.05

Lending No-No Update

The stock secured loan to Phillip Bennett mentioned in my Lending No-No article was, in fact, unhedged, according to this RefCo article in the Journal.

Given what should have been known by the lender, that may have been the worst loan in modern Western World history. At some point, I'm going to have take nominations for worst loans ever. I would definitely count the 57 different Chinese banks that lent money to one guy (which he used to speculatively buy apartments in Hong Kong) as one loan.

The Refco stock Mr. Bennett pledged as collateral for the loan is now nearly worthless, damaging Bawag's own financial situation. Earlier this week, ratings firm Moody's Investors Service said the loan exposure represents a material proportion of the bank's core equity and more than two times Bawag's estimated 2005 earnings. Moody's is concerned that the potential loss content of this exposure could negatively affect the bank's capitalization."

Given what should have been known by the lender, that may have been the worst loan in modern Western World history. At some point, I'm going to have take nominations for worst loans ever. I would definitely count the 57 different Chinese banks that lent money to one guy (which he used to speculatively buy apartments in Hong Kong) as one loan.

17.10.05

JD's Lending No-No's: #1a and #1b

Juggles has his investment commandments, I've got my Lending No-No's, and it's all you need to manage the risk in your debt investments.

- Lending No-No #1a: Consider the collateral. Never take stock as collateral for a loan if it's offered by the CEO of a company who is at the center of a multi-billion dollar securities fraud.

Examples: - The ongoing Refco (Refco) Securities Fraud Stock Scandal hinged on CEO Phillip Bennett's status as an unreported debtor of $430mm to the company. When this came to light on Monday, Bennett repaid the $430mm with cash money. Where did he get this cash money from? Per this NY Post article:

On Monday, Bennett paid back the $430 million plus interest by pledging 43 million Refco shares in return for a loan from The Bank for Arbeit and Wirtschaft AG in Austria.

The Bank for Arbeit and Wirtschaft committed a classic lending no-no and forgot to consider the collateral. It is likely they hedged their position but it was still a bad loan.

Update: The $430mm loan was unhedged. Probably the worst loan ever. - Lending No-No #1b: Consider the collateral. That trademark which is part of your security package? If you ever need it, it will have no liquid value.

Examples: - Frequently, companies with trademarks will include them as collateral in loans. So a company such as The Gap Stores would hire a third party to perform a valuation of their brand and come up with a figure say $XYZmm dollars. We all know that $XYZ dollars is a lot of money, but that brand's value is really only a barometer for how well the company's stores are doing. If you ever needed to sell that trademark to make a recovery on your high yield bonds or whatever paper you foolishly hold, you can expect to get $XYZmm - $XY0mm for it. That would leave you with just $Zmm left over (see our earlier research on $Z); you can't win with math like that, which is why you always have to consider the collateral.

14.10.05

Discuss: Riding Segway Doubles Firm's Stock Price

That picture of Amazon CEO Jeff Bezos was taken in November 2002. How do you reconcile that with this AMZN Stock Perf Chart:

Discuss.

Edit 10/17: Kaiser sent me this picture which may show that riding the Segway produces a similar reaction in Bezos as staring down Anna Kournikova. If you notice, it's quite possible that he is riding a segway in that shot. That is the beauty of the segway, you just never can tell.

13.10.05

Companies I Hate (continued)

A number of online photo companies have recently been threatening to delete my photos if I don't make a purchase. For instance, I received the following in an email from Kodak Easyshare:

Recommendation: Short Kodak. Short bad customer service. Short automated responses.

We're happy to store all your memories at the Kodak EasyShare Gallery, but because you haven't made a purchase in the last 12 months, we may begin deleting stored images from your account. Don't risk losing your photos!Maybe I'm the exception but deleting my photos doesn't qualify you for my bi-annual "happy to store your memories" award. In fact, I will probably send you an email telling you that I never plan to use your service again. Here was their response:

Thank you for contacting the KODAK EASYSHARE Gallery Customer Service Team.What a followup! Thanks for emailing me to tell me you won't be responding. And what, pray tell me, is the purpose of a customer service email if no one checks it!?! I appreciate your attention to my concerns; I will never purchase another Kodak product as long as I live.

We wanted to let you know that we've just received your message. A Customer Service representative will not respond to this email. [My emphasis]

Recommendation: Short Kodak. Short bad customer service. Short automated responses.

12.10.05

About that $430mm Accounts Receivable owed from me...

....was that uncool?

Full disclosure to our readers; I actually owe Long or Short $430mm. In a confidence business such as the delivery of genius, our customers (you) have to be worried about whether our lack of internal controls will affect the delivery of future content, or if this will delay or otherwise hinder the release of my next set of Investing Commandments. Rest assured that this kind of thing is totally cool because we all do it. I asked our internal auditors about it and they actually used the phrase "Dude, that's totally cool."

According to these same auditors, the whole Refco (ticker: RFX) stock thing is totally overblown, and Tyco's internal controls were "wicked awesome," so our controls are probably pretty good. In light of this, we rate our own stock as market outperform. Go long the equity, but be sure to short the bonds.

Recommendation: SOX rocks!, long white collar prison sentences, short "the bonds" and private equity's due dilligience

PS if this post was incomprehensible, start here.

Full disclosure to our readers; I actually owe Long or Short $430mm. In a confidence business such as the delivery of genius, our customers (you) have to be worried about whether our lack of internal controls will affect the delivery of future content, or if this will delay or otherwise hinder the release of my next set of Investing Commandments. Rest assured that this kind of thing is totally cool because we all do it. I asked our internal auditors about it and they actually used the phrase "Dude, that's totally cool."

According to these same auditors, the whole Refco (ticker: RFX) stock thing is totally overblown, and Tyco's internal controls were "wicked awesome," so our controls are probably pretty good. In light of this, we rate our own stock as market outperform. Go long the equity, but be sure to short the bonds.

Recommendation: SOX rocks!, long white collar prison sentences, short "the bonds" and private equity's due dilligience

PS if this post was incomprehensible, start here.

7.10.05

Short Crazy Cabbies

"It's great to be back in the cab. First day back since my license got taken away."

-heard as I got in a taxi yesterday

He was a 55yo drugged out looking cabbie, and he managed to get me to the BCBG Max Azria investors' meeting, while talking to himself and with his mood oscillating between jubilation and severe angritude. I survived, but I wouldn't buy stock in the likelihood that all his passengers survive.

Recommendation: Short insane people driving me places.

-heard as I got in a taxi yesterday

He was a 55yo drugged out looking cabbie, and he managed to get me to the BCBG Max Azria investors' meeting, while talking to himself and with his mood oscillating between jubilation and severe angritude. I survived, but I wouldn't buy stock in the likelihood that all his passengers survive.

Recommendation: Short insane people driving me places.

5.10.05

Fertilizer and Fighter Jets

Scotts Miracle-Gro is a manufacturer/marketer of branded lawn and garden products. You would probably recognize some of their brands like Scotts, Miracle-Gro and Ortho as stuff you put on your lawn. Their CEO Jim Hagedorn (who owns a ton of the stock), is a retired Air Force pilot and is wont to ramble. In his closing remarks at last year's Investor/Analyst Day, he created an epic meditation on fertilizer, the power of greed and war:

Recommendation: Long inappropriate analogies

-JD

ps. As an investor, this is a pretty stock chart.

"I didn't get out of flying fighters to be a fertilizer salesman. I got out of fighters because I think it's a more pure form of conflict here."I don't disagree.

"It's like the purest form of conflict in that like nobody really dies, but think how many volunteers you'd have if you could go over to Iraq and you could take all the money you could find?"Perhaps becoming President or at least Secretary of State would be an even purer form of conflict than the fertilizer business, because we need to get these ideas into policy ASAP.

"This is what it's like! I really like this business. I may be scaring you, I'm sorry."No, not at all. We already said how much we agree, Jim.

"But think about it! We get encouraged to basically compete -- it's a good thing. It's okay to win. It's okay to take market share which is just real estate -- it's imperialistic."This is exactly the kind of CEO I want in charge of a $2bn revenue, $300mm EBITDA, $2.5bn market cap company. He should also own ~40% equity in the company. Thankfully, he does, that financial imperialist son-of-a-gun.

Recommendation: Long inappropriate analogies

-JD

ps. As an investor, this is a pretty stock chart.

4.10.05

Just Heard in My Morning Meeting

"They're doing ok in pickles, getting their ass kicked in fish"

First person to name the company being talked about gets a link in this post. Update: Mara was the first to name the company and here is her link which you must click.

Recommendation: Long pickles and Mara, short fish.

Smooches,

JD

First person to name the company being talked about gets a link in this post. Update: Mara was the first to name the company and here is her link which you must click.

Recommendation: Long pickles and Mara, short fish.

Smooches,

JD

3.10.05

Department of Redundancies Department

Legalese always contains redundancies but the findings by IPG's accountants in their recent restatment take this to a new level. The accountants listed 18 areas of weakness needing improvement including:

"1. The Company did not maintain an effective control environment.

18. The Company did not maintain effective controls over monitoring the performance of proper application of the Company’s internal controls over financial reporting and related policies and procedures."

Keep in mind that these comments all appeared in the section devoted to the assessment and identification of weakness in controls.

In fairness to the flight attendants whom I maligned in my last post, accountants shouldn't be considered professionals either. The section on controls is one big CYA move.

Keep in mind that these comments all appeared in the section devoted to the assessment and identification of weakness in controls.

In fairness to the flight attendants whom I maligned in my last post, accountants shouldn't be considered professionals either. The section on controls is one big CYA move.

30.9.05

Is a Flight Attendant a Professional?

Kaiser inadvertently raised another point in his post (below). When did flight attendancy become a profession? Yes, the word can be used in a broad sense but doesn't a "professional" usually hold as an occupation requiring specialized training? Lawyers, doctors, scientists; those are people you can call "professionals." Flight attendants are (sometimes) lovely people but last time I checked they didn't have to attend graduate school, pass any grueling exams, or even show me how to buckle my seat belt now that they have those new-fangled TV screens.

Recommendation: Short unions and pretension, in size.

Recommendation: Short unions and pretension, in size.

29.9.05

Judge Shows Investment Savvy

From the NYPost:

September 28, 2005 -- AMERICA'S first black female billionaire just got remarried. Sheila Johnson, the ex-wife of BET founder Robert Johnson, tied the knot with Judge William Newman at her Salamander Farm in Middleburg, Va., on Saturday. Newman met Johnson when he presided over her 2002 divorce case against Robert, her husband of 33 years. Newman's decision evenly split the $3 billion Johnson netted after Viacom bought BET.I have to give credit where it's due. This judge ruled over a divorce case involving a billionaire, split the $3bn evenly, and then marries the now-divorced-but-also-a-billionaire woman? Wow. That's how you use the law to your investing benefit.

28.9.05

Mr Juggles Investing Commandments (#1 & #2)

People often ask me, "Mister Juggles where should I invest?" or "How should I decide whether to buy Company X's stocks, bonds, options and exotic derivatives?" To that end, I have decided to create a list of investment rules that will allow readers to quickly qualify or rule out certain companies as potential investments. This process will continue over time as these rules come to mind.

Note: Rules are not ranked in order of importance.

- Rule #1: Avoid any company if the company's CEO responds to a legitimate question with profanity and/or personal attacks. This applies double if the profanity occurs during a quarterly conference call. Consider shorting the stock or buying out-of-the-money put options.

Examples: - Patrick Byrne (Overstock) responded to certain allegations by a research firm suggesting that the authors should be "be beaten, f---ed, and driven from the land."

- Jeff Skilling (Enron) swore at an analyst who asked why Enron couldn't produce a balance sheet and cash flow statement along with the income statement at the time of the quarterly conference call.

- Rule #2: Avoid companies that engage in transactions wildly unrelated to their core business.

Examples: - When Delta filed for bankruptcy both EDS and Disney disclosed writedowns related to aircraft leasing arrangments with Delta. EDS is a business process management company and Disney, of course, offers media and family entertainment. Neither company should, despite their disclosures of the leases, be in the business of aircraft leasing. Last time I checked the synergies between running a company that creates animated films for the pre-K set and vetting leasing arrangements with bankrupt companies were fairly low.

Note: Rules are not ranked in order of importance.

26.9.05

Pronk market outperform; Papa Grande overweight

"Pronk" is the nickname of Cleveland Indians star 1B/DH Travis Hafner, while "Papa Grande" is the nick of Diamondbacks reliever/closer Jose Valverde. Hafner's has the edge since someone called him "part project, part donkey" and that stuck as "Pronk." It also happens to be MY nickname....in bed.

Baseball nicknames hit a trough in the late 90's but are inherently cyclical, so slip some capital into the sector. I doubt we'll see the halycon days of "Death to Flying Things", but it looks like a decent bet to provide solid returns in a tough investing climate.

Recommendation: Long Pronk, Papa Grande, Baseball Nickname sector

Baseball nicknames hit a trough in the late 90's but are inherently cyclical, so slip some capital into the sector. I doubt we'll see the halycon days of "Death to Flying Things", but it looks like a decent bet to provide solid returns in a tough investing climate.

Recommendation: Long Pronk, Papa Grande, Baseball Nickname sector

23.9.05

Cockpit Humor United

From the captain on a recent flight:

"Thank you for flying United. We know you have your choice of bankrupt carriers and we appreciate your choosing United."

Nice work United captain! Color me amused. I hereby pledge to help alleviate your company's fiscal situation and fly United on my next journey as long as you offer me the lowest price.

"Thank you for flying United. We know you have your choice of bankrupt carriers and we appreciate your choosing United."

Nice work United captain! Color me amused. I hereby pledge to help alleviate your company's fiscal situation and fly United on my next journey as long as you offer me the lowest price.

Learned/Heard/Seen This Week at BofA Conference

• After seeing that clip, I wish I was in the virtual ammunition business.

• Guy with a button on the back of his collar. The dress shirt equivalent of the superfluous third nipple.

• I have been replaced by my wife's scottish terrier.

• We looked at Meow Mix, but we passed because we didn't think we had the platform for it. But then, neither does Cypress [private equity shop who bought MM], but what do financial guys know anyways. [pause] Don't tell them I said that.

• You can have a cup of Starbucks, or you can clothe your child.

• Buy our bonds, short our stock, try some capital structure arbitrage!

• Everyone from Lord Abbett seemed to be over 70 and at least part troll. Picture the last scene in Rosemary's Baby. Now picture everyone who wasn't John Cassavetes or Mia Farrow or the antichrist. Those are the people managing money for Lord Abbett.

• Puppie adoptions were up 40% after 9/11.

• My hunch is that there were far more people from Bank of America at the Bank of America Equity Conference than people not from BofA; the ratio of suits to non-suits speaks to this. Who wears a suit to a business casual conference?

Points are awarded to who can attribute which thing to which session. Note that we only have 14 points. Also note that not all points are equal.

-JD

• Guy with a button on the back of his collar. The dress shirt equivalent of the superfluous third nipple.

• I have been replaced by my wife's scottish terrier.

• We looked at Meow Mix, but we passed because we didn't think we had the platform for it. But then, neither does Cypress [private equity shop who bought MM], but what do financial guys know anyways. [pause] Don't tell them I said that.

• You can have a cup of Starbucks, or you can clothe your child.

• Buy our bonds, short our stock, try some capital structure arbitrage!

• Everyone from Lord Abbett seemed to be over 70 and at least part troll. Picture the last scene in Rosemary's Baby. Now picture everyone who wasn't John Cassavetes or Mia Farrow or the antichrist. Those are the people managing money for Lord Abbett.

• Puppie adoptions were up 40% after 9/11.

• My hunch is that there were far more people from Bank of America at the Bank of America Equity Conference than people not from BofA; the ratio of suits to non-suits speaks to this. Who wears a suit to a business casual conference?

Points are awarded to who can attribute which thing to which session. Note that we only have 14 points. Also note that not all points are equal.

-JD

22.9.05

Dear Girl, I'm long you

I realize that, given our exploding traffic patterns, you have probably already read my colleague's callous post. Unlike him, I think you're cute as a button. I want to be long you, in size. Please contact me so we can make babies and live happily ever after.

Sincerely,

Mister Juggles

misterjuggles@gmail.com

P.S. I am completely serious about this.

Sincerely,

Mister Juggles

misterjuggles@gmail.com

P.S. I am completely serious about this.

This Girl is Not Attractive, so Short Her

Or more appropriately, you need to seperate nubility from future attractiveness. [This is a response to Juggles and Edamame]

• This is a flattering photographic situation. Slightly shaded, one side of the face, not too close. She could have giant legs and a fupa complementing her subpar bosoms. We don't know.

• Her face could be anything. She's 19 and while she has the blush of youth, she does not seem to have the structure either in face or in body to withstand age and maintain any attractiveness, which she may or may not currently have. She will trend down, and then lose all she's got by 31 when she will have the superficial sexual appeal of tapioca pudding.

• She appears to have a chalky residue on the side of her feet. That is unacceptable and it's example as to why you always have to check out the feet before consumating the relationship.

• I guarantee you she is awful in bed.

• While you both may agree, there is nothing that precludes you from both being wrong.

-JD

Background: Juggles linked me to this NY Times article, which focuses on girls who are on high riser tracks, are amibitious careerwise and attend prestigous schools but fully plan to end their careers and become stay-at-home mom's at some as to yet undetermined point in the future. He wrote "she is cute, sign me up" (he actually writes like that) and that Kaiser agreed with him.

Recommendation: Short Emily Lechner and also Edamame and Juggles's projection of women; long JD.

16.9.05

Long Self-Involvement

Our last two posts have been about ourselves, I'm sensing a trend. When I sense a trend, I lay down the big bones.

Recommendation: JD = Long Self-Involvement

Recommendation: JD = Long Self-Involvement

15.9.05

Short Blogsnob/Pheedo

Blogsnob sucks. Pheedo sucks.

Long or Short has served roughly 4,000 impressions for Blogsnob/Pheedo. It's supposed to be such that for each impression we serve we get a credit for 2/3 of an ad of ours to be served on another part of the Blogsnob network. This is the idea of traffic sharing. Our ads have been served at a rate below 20% of the amount we have served. This is the idea of traffic thieving. We have 2 clickthroughs to our site. What is the point? Pheedo is a bad service. When we short you, we crush you. Pheedo, you are crushed.

Long or Short has served roughly 4,000 impressions for Blogsnob/Pheedo. It's supposed to be such that for each impression we serve we get a credit for 2/3 of an ad of ours to be served on another part of the Blogsnob network. This is the idea of traffic sharing. Our ads have been served at a rate below 20% of the amount we have served. This is the idea of traffic thieving. We have 2 clickthroughs to our site. What is the point? Pheedo is a bad service. When we short you, we crush you. Pheedo, you are crushed.

Recommendation: Short Pheedo.

Long or Short has served roughly 4,000 impressions for Blogsnob/Pheedo. It's supposed to be such that for each impression we serve we get a credit for 2/3 of an ad of ours to be served on another part of the Blogsnob network. This is the idea of traffic sharing. Our ads have been served at a rate below 20% of the amount we have served. This is the idea of traffic thieving. We have 2 clickthroughs to our site. What is the point? Pheedo is a bad service. When we short you, we crush you. Pheedo, you are crushed.

Long or Short has served roughly 4,000 impressions for Blogsnob/Pheedo. It's supposed to be such that for each impression we serve we get a credit for 2/3 of an ad of ours to be served on another part of the Blogsnob network. This is the idea of traffic sharing. Our ads have been served at a rate below 20% of the amount we have served. This is the idea of traffic thieving. We have 2 clickthroughs to our site. What is the point? Pheedo is a bad service. When we short you, we crush you. Pheedo, you are crushed.Recommendation: Short Pheedo.

14.9.05

I'm Long these 7 Posts

Self-analysis of the Long or Short Industry. Judged and ranked for the strongest combination of humor and truth.

Recommendation: Give us your money. Riches will follow. We're long Long or Short?. Feel free to advocate for your favorite.

Full disclosure: We are Long or Short, which may or may not bias our opinions of ourselves. All external advocacy will be ignored.

- Perf: The Next Big thing. Abstract, yet tangible. And clearly, very true.

- Supreme Court Dance Parties: Long. Truth was strong in this analysis, as this has been upgraded to Chief Justice Dance Parties, within only a month of our post.

- Visteon: Analysis of New Ideas. A graph and fraternal due dilligience. This is why we're the best there are at what we do.

- Racialistness: Markets in Soul and Respect. An overview of the impact of the inputs of "soul" and "respect" on the music markets.

- Proposed Changes to Koran Pt 1: Mortgage Friendly. Everyone wants an ARM these days, let's not let religion prejudice a group of potential homeowners against "freedom" financing.

- Mudpies, Creampies: Short, Long. Prefaced the whole OSTK hubbub. THAT is how you analyze.

- The Number Z: Preempting the trend. Like Perf, but with numbers. When is the last time a truly new whole number came along?

Recommendation: Give us your money. Riches will follow. We're long Long or Short?. Feel free to advocate for your favorite.

Full disclosure: We are Long or Short, which may or may not bias our opinions of ourselves. All external advocacy will be ignored.

12.9.05

Updating Cephalopod Position: Shark vs Octopus

Justifying our cephalopod recommendation from July, witness this video in which a giant pacific octopus dominates a shark in acquatic combat. Here is the footage. We reiterate our long position. Keep in mind that if the stock begins to tick up, there is a lot of tentacle pressure that could push it through the roof.

Background via Collision Detection:

Background via Collision Detection:

Okay, so -- the Seattle aquarium had a couple of Giant Pacific Octopi, and for logistical reasons they had to temporarily put one of them in a tank holding several sharks. They figured the octopus would be okay because it can change color to conceal itself from predators. But over the next week, the marine scientists came into work to find sharks are lying dead on the floor of the aquarium. Whatever was going on? They stayed around one evening and trained a camera on the water to see.

11.9.05

You have only 375 songs on your iPod: The Idiot Demographic

I've been thinking about music technology on a couple levels. First of all, I've been drawing together a proper music snobbery response to two of Craig Newmark's posts, the first about how technology has killed the rock snob star and letting him know what the perfect album is. During this process, I came across this tidbit of information via CD.com: the overwhelming majority of people use only a paltry percentage of their iPod's total capacity.

Why is that? The most obvious answer to me is that most people have such small brains that they can only handle having 375 options available to them. The second most obvious answer is that there is a constant 18 month moving average of 375 top 40 songs.

But why do people continue to buy iPod's, and other digital music players, at capacity levels which they won't ever approach? Because people are stupid and cannot properly gauge what they need. Alternatively, people are vulnerable to the power of marketing featuring Bono gyrating in bizarro shadow relief video style.

A running theme here at LOS.com is that in every group of people, most of them will be idiots. Applying this maxim here, in any group of iPod owners, most of them will be idiots. This is good news for Apple.com as any growth they hope to achieve, now that everyone and my mother has an iPod, is dependent on the continued existence of the Idiot Demographic (aka TID). Oh you have released a product which already far outstrips anything I need, costs twice as much, and is difficult to order? I must have the OmegaPod Mini Shuffle !

!

We think that you can always bank on idiocy. The post-war diamond industry was built upon this. So we will continue to focus on business plans and companies which are dependent upon TID. Future entries in this series include "Why own when you can lease for 50% more? The Rent-A-Center Story" and "SBUX: Hot water and filtered dirt for $4.50."

Full Disclosure: JD owns an iPod Mini and an iPod Shuffle

and an iPod Shuffle . He fully embraces his inner-hypocrite.

. He fully embraces his inner-hypocrite.

Why is that? The most obvious answer to me is that most people have such small brains that they can only handle having 375 options available to them. The second most obvious answer is that there is a constant 18 month moving average of 375 top 40 songs.

But why do people continue to buy iPod's, and other digital music players, at capacity levels which they won't ever approach? Because people are stupid and cannot properly gauge what they need. Alternatively, people are vulnerable to the power of marketing featuring Bono gyrating in bizarro shadow relief video style.

A running theme here at LOS.com is that in every group of people, most of them will be idiots. Applying this maxim here, in any group of iPod owners, most of them will be idiots. This is good news for Apple.com as any growth they hope to achieve, now that everyone and my mother has an iPod, is dependent on the continued existence of the Idiot Demographic (aka TID). Oh you have released a product which already far outstrips anything I need, costs twice as much, and is difficult to order? I must have the OmegaPod Mini Shuffle

We think that you can always bank on idiocy. The post-war diamond industry was built upon this. So we will continue to focus on business plans and companies which are dependent upon TID. Future entries in this series include "Why own when you can lease for 50% more? The Rent-A-Center Story" and "SBUX: Hot water and filtered dirt for $4.50."

Full Disclosure: JD owns an iPod Mini

30.8.05

I Love You Honey. And This Time I Mean It.

The diamond industry has tailored over 70 years of marketing around the idea that a marriage is NOT a marriage without the BLING. Their recent campaign underscores their updated message in a world where the role and composition of marriage is changing.

Say "I Forever Do" as opposed to the first time you made that promise....but didn't really mean it. Well now you mean it forever, you do.

Another gem:

In the past, many men have tried to show their devotion by treating their wives with respect, providing for them, and accompanying them to watch romantic comedies involving a woman and her bookstore (or a woman, her dog and a bookstore. Or a woman, her dog, and her 3 best friends, one of whom owns a bookstore and meets guys on IM). And they were all wrong. Thanks to the diamond industry and their products backed with extensive empirical romantical experimentation, we now know that only the gift of a diamond will suffice to show your wife that you will love her for foreverido.

This anniversary, show her your love is everlasting by saying "I Forever Do."

Say "I Forever Do" as opposed to the first time you made that promise....but didn't really mean it. Well now you mean it forever, you do.

Another gem:

Only the gift of a diamond, as timeless and unique as your love, shows her you would marry her all over again.

In the past, many men have tried to show their devotion by treating their wives with respect, providing for them, and accompanying them to watch romantic comedies involving a woman and her bookstore (or a woman, her dog and a bookstore. Or a woman, her dog, and her 3 best friends, one of whom owns a bookstore and meets guys on IM). And they were all wrong. Thanks to the diamond industry and their products backed with extensive empirical romantical experimentation, we now know that only the gift of a diamond will suffice to show your wife that you will love her for foreverido.

24.8.05

14.8.05

Proposed Changes to the Koran: Part 1

My knowledge of Islamic doctrine is admittedly limited -- I'm the same guy who thought that "Mecca" was a low-carb energy drink until early last week. Apparently, the Koran prohibits the paying or receiving of interest. It's high time for Muslim leaders to update that belief because they're missing out on the American dream and the greatest invention of the modern age: sophisticated financial products. Why should I be able to own 6 condos in Miami (and a duplex in the Valley) while Muslims everywhere are forced to barter for housing?

It just seems like the type of situation where Muslim leaders should get together and say "Ok, from now on, this rule only applies to excessive interest. No loan sharking but that mortgage from Countrywide is A-OK."

I bet Mohammed would have been all about 4.4% fixed rate mortgages. He was only pissed because he had bad credit and the best he could do at the local medieval mortgage broker was a 7.8% 5/1 ARM. No way you want to put that kind of financing on a herd of mangy goats; you can't get gap insurance on them! I'd be pissed too.

It just seems like the type of situation where Muslim leaders should get together and say "Ok, from now on, this rule only applies to excessive interest. No loan sharking but that mortgage from Countrywide is A-OK."

I bet Mohammed would have been all about 4.4% fixed rate mortgages. He was only pissed because he had bad credit and the best he could do at the local medieval mortgage broker was a 7.8% 5/1 ARM. No way you want to put that kind of financing on a herd of mangy goats; you can't get gap insurance on them! I'd be pissed too.

13.8.05

Short My Own Brain

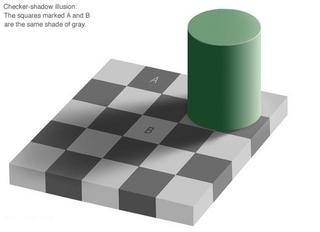

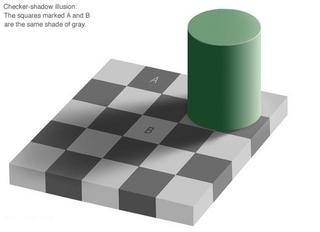

JD here and my brain has been blown by the guys at MR. TC and AT usually hit me up with some mind bending econ, but this is something that has broken my cognitive visual powers to the nth degree. In this image square A and square B are the same shade of gray.

No, I didn't believe it either. I looked it from every angle, I used every visual queue and I even tried some 3D glasses. Then KM hit me with this proof. Thanks KM, my brain is feeling less vulnerable now. My intuition will bounce back though, so be ready to jump on it long in the near future. Big time. JD out.

No, I didn't believe it either. I looked it from every angle, I used every visual queue and I even tried some 3D glasses. Then KM hit me with this proof. Thanks KM, my brain is feeling less vulnerable now. My intuition will bounce back though, so be ready to jump on it long in the near future. Big time. JD out.

11.8.05

Aliboohoo: 你的爸爸是谁

Yes yes, this whole $1bn Yahoo-Alibaba stake aquisition deal is big news to some people and I'm sure it will have some sort of really important impact on China, Indochine, Siam and all those places.

But all these stock-crazed investors are missing the glorious naming opportunities as the two funniest corporate names come together as one. When they inevitably decide to create new names and rebrand all their products, a total no-brainer in this analyst's opinion, the possibilities will be endless.

Yahooba has already been penned, but let's delve into my grab bag of branding brilliance:

Aliboohoo. It calls attention to the emptiness of life and the pathos associated with a capitalistic bourgeois existence.

Yalibaboo!. Alludes to a distant time, the golden age of our Half-Human Half-Dinosaur ancestors, who founded civilization 33,000 years ago and created badmitton (still played to this day, the oldest sport in continuous existence).

Baba ali,ya? Hoo!. Who am I? Why am I here? What is the meaning of life? Hoo!

Aliyahooblies. It booms out at you, making its presence felt from the very bosom of inspiration.

American China Auction and Search Corp. Provocative. Basic. Dynamic.

Hot-Hand in the Mahjong Game Inc

It pained my heart to learn that Who's Your Daddy is already taken by a licensing company; but 你的爸爸是谁 is still available.

It's obvious to you that these names are positioned for explosive growth because, well, we said so, and that's all the analysis you need. Strong Buy with a current price target of !.

But all these stock-crazed investors are missing the glorious naming opportunities as the two funniest corporate names come together as one. When they inevitably decide to create new names and rebrand all their products, a total no-brainer in this analyst's opinion, the possibilities will be endless.

Yahooba has already been penned, but let's delve into my grab bag of branding brilliance:

Aliboohoo. It calls attention to the emptiness of life and the pathos associated with a capitalistic bourgeois existence.

Yalibaboo!. Alludes to a distant time, the golden age of our Half-Human Half-Dinosaur ancestors, who founded civilization 33,000 years ago and created badmitton (still played to this day, the oldest sport in continuous existence).

Baba ali,ya? Hoo!. Who am I? Why am I here? What is the meaning of life? Hoo!

Aliyahooblies. It booms out at you, making its presence felt from the very bosom of inspiration.

American China Auction and Search Corp. Provocative. Basic. Dynamic.

Hot-Hand in the Mahjong Game Inc

It pained my heart to learn that Who's Your Daddy is already taken by a licensing company; but 你的爸爸是谁 is still available.

It's obvious to you that these names are positioned for explosive growth because, well, we said so, and that's all the analysis you need. Strong Buy with a current price target of !.

9.8.05

The New Guy

Hello. I'm a new poster, my name is Johnny Debacle. JD for short. My MO is abbreviations. Because nothing beats a good abbrev. Well, nothing other than a cooler, better abbrev. The only abbrevs that I can't stand are overused, hackneyed abbrevs (e.g. LOL et al). But really, comparing abbrevs? Come on, find a better use of time.

I've noticed some of the other longorshort bloggers using really big words so I thought I'd kick it off by helping the readers who don't understand them.

iconoclast - this refers to a person who grabs on to icons, usually the ones on his desktop, and then drags them all over the place with no regard for human life. I know, random word huh?

esoteric - this word is only understood by a small group of people, I couldn't get a hold of them to get a definition.

Finally I'd like to say that I am the man. I was watching Miss Teen USA last night, and turned to my buddy right when Miss Teen Ohio walked out and I said: "she's the best, she's got the goods". Two thrilling hours later, she was crowned.

Now she's moving to New York and has free hair care for a year, and boy did she earn it. I can't wait to email her. Also, her favorite song is "Eye of the Tiger," what a GREAT answer to that question, ha, eye of the tiger, that's just great.

4.8.05

Initiating Coverage of the Little People Sector

We are initiating coverage on the Little People sector with the following ratings.

Gnomes - UNDERWEIGHT

Sky Gnomes - OVERWEIGHT

Dwarves - OVERWEIGHT

Elves - EQUALWEIGHT

Gnomes

Gnomes have been fading after a strong 2 year run fueled by gnome icon Giles Standish's turn as the Travelocity spokesman. Giles took gnomes to previously unattained levels and improved the group's overall reputation. Unfortunately, all good things must end and Travelocity recently announced a revamped marketing plan that included an early retirement for Giles. We wish him the best but downgrade the group as it appears unlikely that gnomes as a whole will be able to comp against the Giles loss, at least for the next year. Sell....

Read More

Gnomes - UNDERWEIGHT

Sky Gnomes - OVERWEIGHT

Dwarves - OVERWEIGHT

Elves - EQUALWEIGHT

Gnomes